Last updated on

Sep 27, 2024

Customize and complete your essential Settlement Statement template

Prepare to streamline document creation using our fillable Settlement Statement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

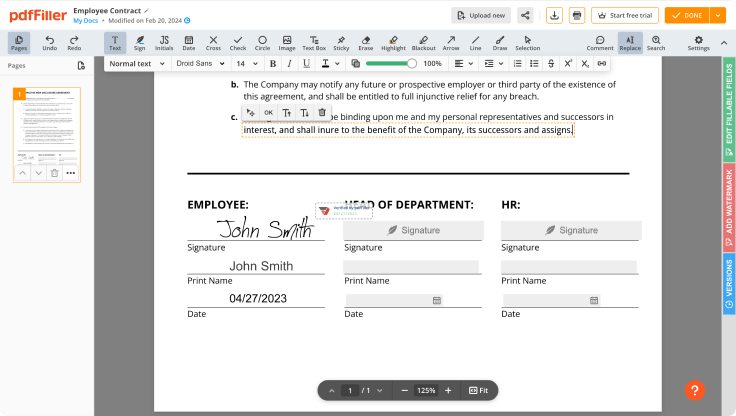

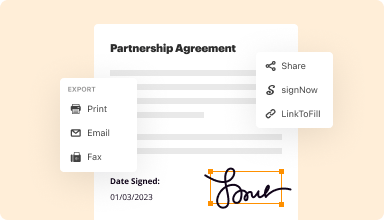

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

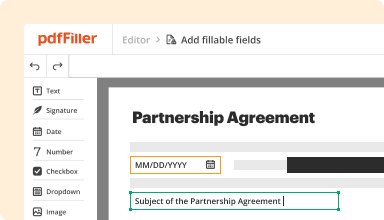

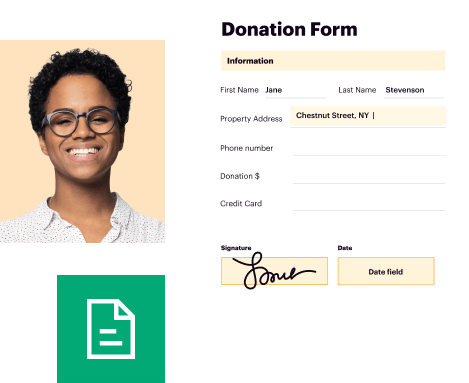

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

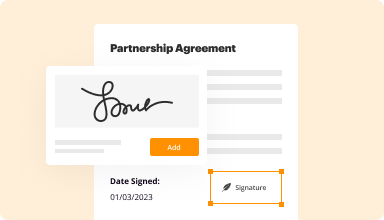

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

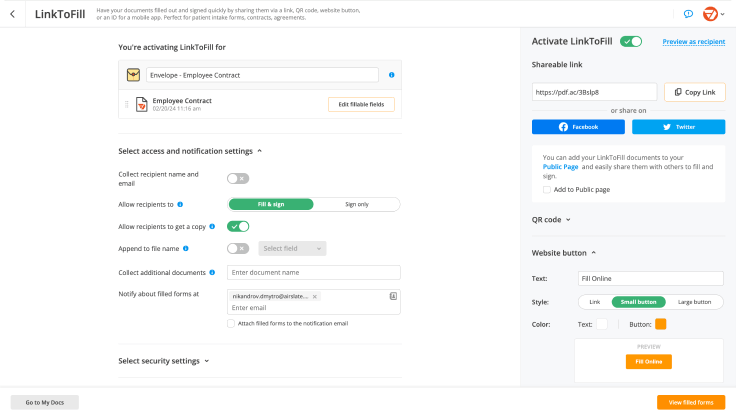

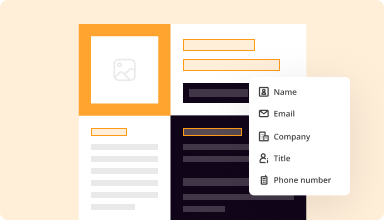

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

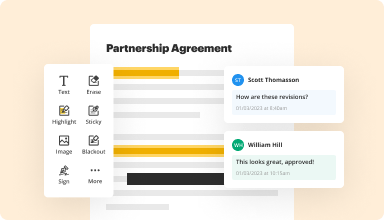

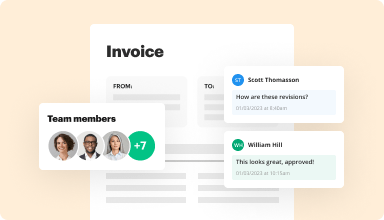

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

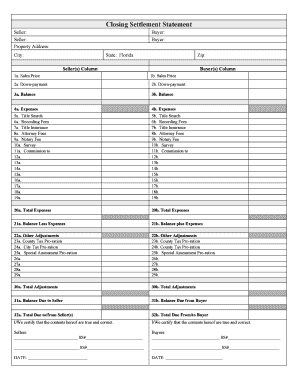

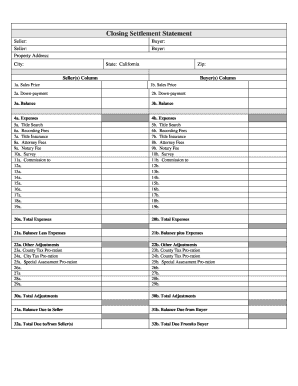

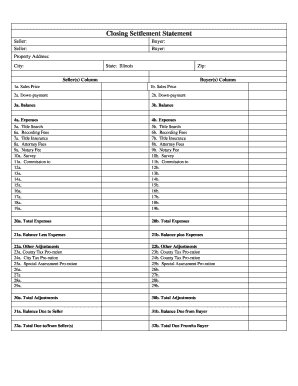

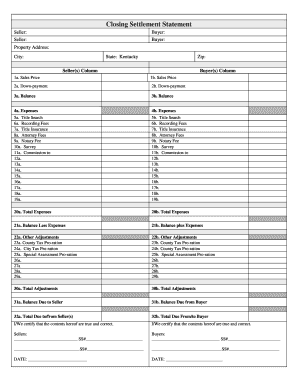

Customize Your Essential Settlement Statement Template

Efficiently manage your real estate transactions with our customizable Settlement Statement template. You can tailor it to suit your specific needs, making it an indispensable tool for agents, lenders, and buyers alike.

Key Features of Our Settlement Statement Template

Fully customizable fields for accurate information entry

User-friendly interface to streamline data input

Option to add or remove sections based on transaction type

Easy export to PDF or other formats for sharing

Compliant with local regulations and standards

Use Cases and Benefits

Real estate agents can personalize documents for each closing

Lenders benefit from quick and accurate mortgage calculations

Homebuyers can easily understand their financial obligations

Property managers can simplify financial reporting for clients

Investors can maintain organized records for multiple transactions

Our customizable Settlement Statement template solves persistent issues of accuracy and clarity in financial documentation. By allowing you to adjust fields and content, it ensures that you present precise information every time. Save time, reduce mistakes, and enhance your professionalism with a tool designed to meet your needs.

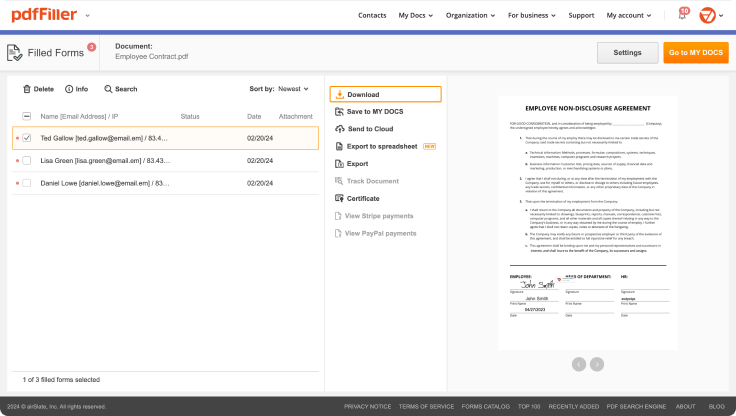

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Settlement Statement

Creating a Settlement Statement has never been so easy with pdfFiller. Whether you need a professional document for business or individual use, pdfFiller offers an easy-to-use solution to create, customize, and manage your documents effectively. Employ our versatile and fillable templates that align with your precise requirements.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to smoothly create polished documents with a simple click. your journey by following our detailed instructions.

How to create and complete your Settlement Statement:

01

Register your account. Access pdfFiller by logging in to your profile.

02

Search for your template. Browse our complete library of document templates.

03

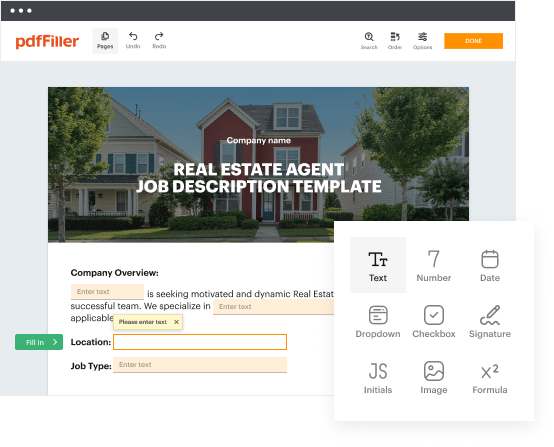

Open the PDF editor. When you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Add text, highlight information, insert images, and make any required changes. The intuitive interface ensures the procedure remains easy.

06

Save your edits. When you are satisfied with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to eSign, download, or securely store it in the cloud.

To summarize, crafting your documents with pdfFiller templates is a smooth process that saves you efforts and guarantees accuracy. Start using pdfFiller right now to benefit from its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

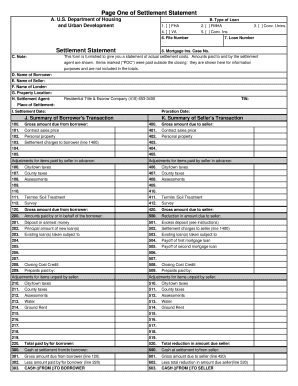

Who completes the settlement statement?

The settlement statement can be provided to the homebuyer and seller by the mortgage lender, a settlement agent, a title company or a real estate attorney.

How to make a settlement statement?

The settlement statement should clearly show the charges and credits for both the buyer and the seller. You should calculate and itemize the amounts for each category, such as the purchase price, earnest money deposit, loan fees, title fees, recording fees, transfer taxes, commissions, prorations, and adjustments.

Who prepares the settlement statement?

Preparing and receiving the closing statement Closing statements are prepared by closing agents, who help facilitate the sale of a property. Typically, closing agents are real estate attorneys, title companies or escrow officers. Closing statements must be issued at least three business days before closing. What is a closing statement in a real estate sale? - Bankrate Bankrate real-estate what-is-a-closin Bankrate real-estate what-is-a-closin

What appears on a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or to the borrower in the case of a refinance). The document also includes the purchase price of the property, loan amount and other details. What Is A Settlement Statement In Real Estate? | Bankrate Bankrate real-estate settlement-state Bankrate real-estate settlement-state

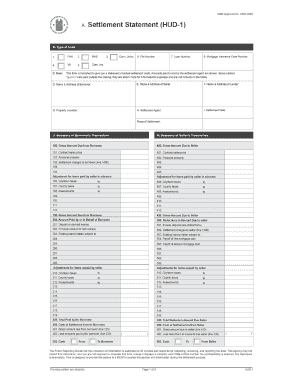

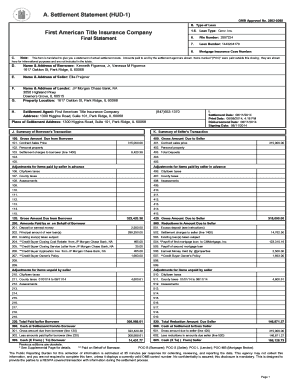

What is the most commonly used form for settlement statements?

The HUD-1 form, also known as the Settlement Statement, is a standardized form used in real estate transactions in the United States.

How many pages is a settlement statement?

three pages The three pages of the HUD-1 form include a summary of all the costs associated with the mortgage (page 1), an itemized list of each expense (page 2) and a comparison between your initial loan estimate and the final settlement (page 3). HUD-1 Settlement Statement Definition - Bankrate Bankrate mortgages hud-1-settleme Bankrate mortgages hud-1-settleme

What is the purpose of the settlement statement?

What Is a Settlement Statement? A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

Is a HUD-1 still used?

HUD-1s are still in use, but in specific situations only. HUD-1s are used in conjunction with reverse mortgages, line of credit loans, residential properties being purchased with commercial loans, and by lenders who do a certain number of loans a year.

What is the difference between a HUD statement and a settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What are the different types of settlement statements?

In mortgage lending, there are two main types of settlement statements a borrower may encounter: closing disclosures and HUD-1 settlement statements. A mortgage closing disclosure is a standard settlement statement that is formulated and regulated for the mortgage lending market.

What is a HUD-1 form used for?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.