Passive Activity Loss Limitations

The templates you get with the Passive Activity Loss Limitations package

Get your paperwork done faster by managing documents in bulk. Get the Passive Activity Loss Limitations package to simplify the process of submitting these forms, doing them simultaneously.

Now you can get all the forms required for filing for tax deduction, certification request, or other common purpose, all in one place, ready to complete and send right away. Each deal features a group of documents available in one place for your own convenience. Use the PDF editor provided by pdfFiller to customize the content or structure of any of the documents included. There are various amending and personalizing features available, all of them grouped into separate toolbars according to the purposes they serve. Once finished, click Done and now you're ready to send the documents out.

The Passive Activity Loss Limitations forms package, as well as the other various form bundles by pdfFiller, allows you to find, prepare, and share required documents in no time, thanks to convenient search algorithms and categorizing. Special template bundles like the Passive Activity Loss Limitations forms package will come in use when you need to file various documents for a particular occasion, as soon as possible. Don't go another day to find your submissions rejected due to improper formatting - get the Passive Activity Loss Limitations forms package, fill out with the required information, put a signature and send out, all within a single platform.

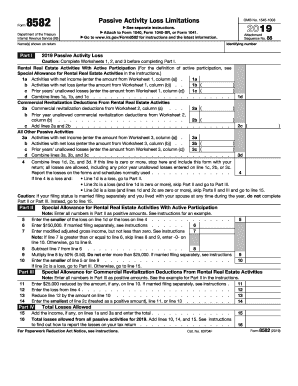

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (PAL) for the current tax year and to report the application of prior year unallowed PALs. ... you did not materially participate for the tax year.

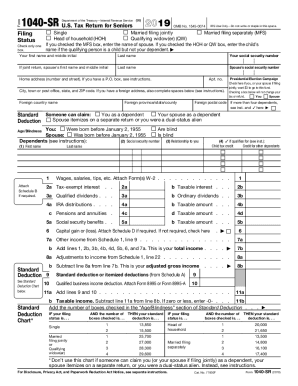

IRS Form 1041 is an income tax return filed by a decedent's estate or living trust after their death. It's similar to a return that an individual or business would file. It reports income, capital gains, deductions, and losses, but it's subject to somewhat different rules than those that apply to living individuals.

Passive Activity Loss Limitations FAQs