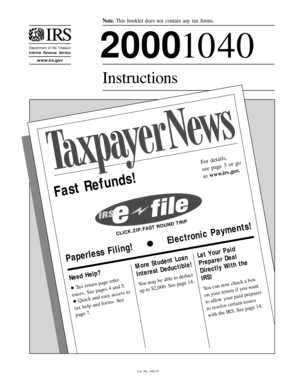

1040 Instructions

What is 1040 Instructions?

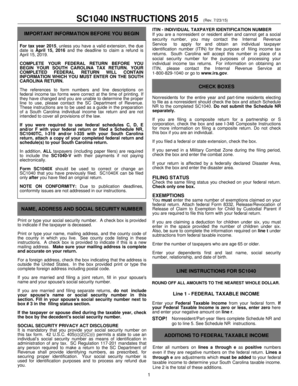

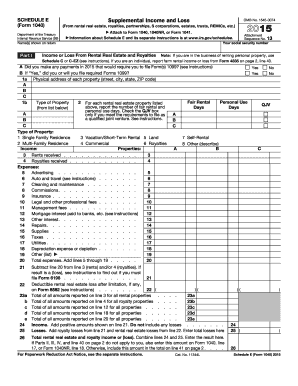

1040 Instructions are a set of guidelines provided by the Internal Revenue Service (IRS) to help taxpayers understand how to accurately fill out their Form 1040, which is the U.S. Individual Income Tax Return. These instructions provide essential information on how to report income, claim deductions and credits, calculate taxes, and complete other necessary steps for filing a federal tax return.

What are the types of 1040 Instructions?

The types of 1040 Instructions include:

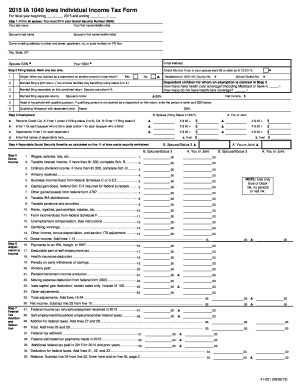

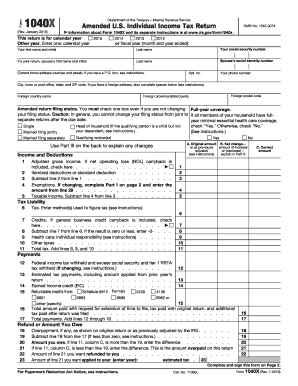

Form 1040

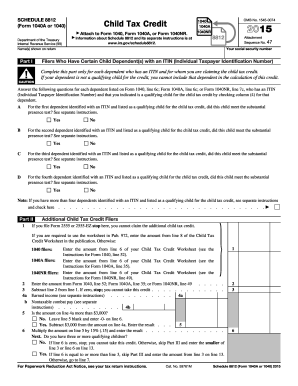

Form 1040A

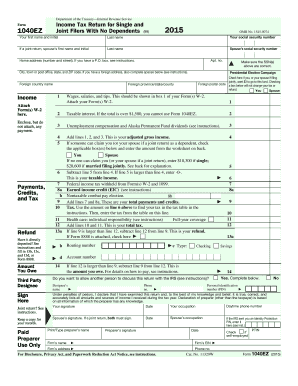

Form 1040EZ

Form 1040NR

How to complete 1040 Instructions

Completing 1040 Instructions involves the following steps:

01

Gather all necessary documents including income statements, W-2 forms, and other supporting documents.

02

Go through each section of the instructions carefully and enter the required information accurately.

03

Follow the provided guidelines for reporting income, claiming deductions and credits, and calculating taxes.

04

Double-check all entered data to ensure accuracy.

05

Sign and date the completed Form 1040 as per the instructions.

06

Keep a copy of your filed tax return for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1040 Instructions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you determine itemized deductions?

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

How do you assemble a 1040?

How to Assemble Paper Tax Returns Sign your return. Prepare your refund or payment information. Gather your tax forms and schedules for assembly. Attach additional statements. Staple all your forms and schedules together in the upper right corner. Attach W-2 and 1099 income documents.

What is an example of an itemized deduction?

Some common itemized deduction to qualify for include: Medical expenses. Property, state, and local income taxes. Home mortgage interest.

How do we calculate income tax?

Income tax calculation for the Salaried Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance.

How much should I claim for itemized deductions?

If the value of expenses that you can deduct is more than the standard deduction (as noted above, for the tax year 2022 these are: $12,950 for single and married filing separately, $25,900 for married filing jointly, and $19,400 for heads of households) then you should consider itemizing.

How do you decide to itemize or take standard deduction?

Here's what it boils down to: If your standard deduction is less than your itemized deductions, you probably should itemize. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard deduction and save some time.

Related templates