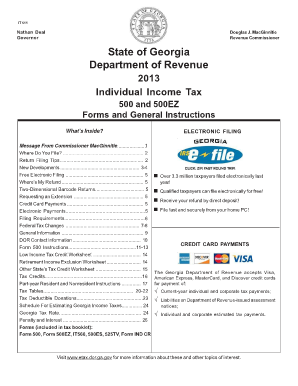

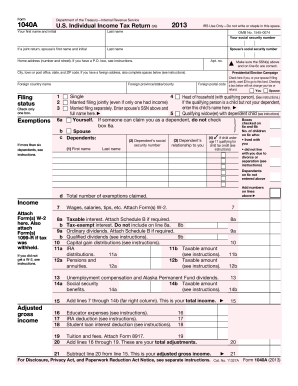

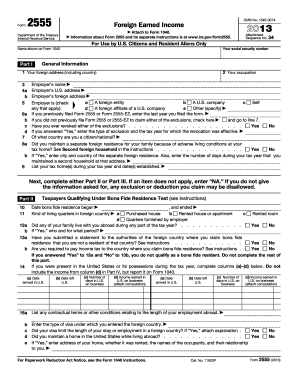

2013 Form 1040 Instructions

What is 2013 form 1040 instructions?

The 2013 form 1040 instructions are guidelines provided by the Internal Revenue Service (IRS) to assist taxpayers in completing their individual income tax return for the year 2013. These instructions outline the various sections of the form and provide explanations on how to accurately report income, deductions, and credits.

What are the types of 2013 form 1040 instructions?

The types of 2013 form 1040 instructions include:

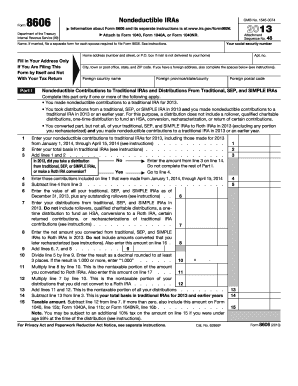

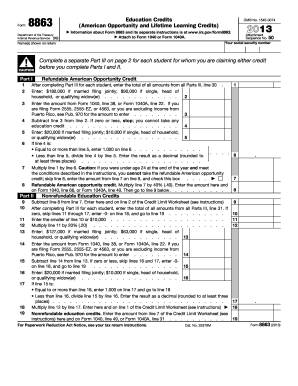

Form 1040 Instructions: These instructions provide general guidance on how to complete the form and report income, deductions, and credits.

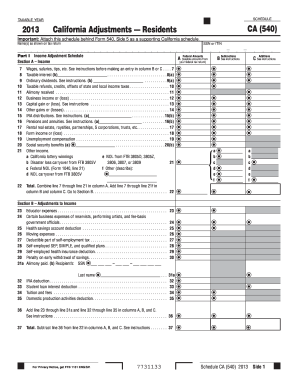

Schedule A Instructions: These instructions provide details on how to itemize deductions if you choose to do so.

Schedule B Instructions: These instructions guide you through reporting interest and ordinary dividends from various sources.

Schedule C Instructions: If you have self-employment income, these instructions help you report your business profit or loss.

Schedule D Instructions: These instructions explain how to report capital gains and losses from the sale of investments.

Schedule E Instructions: If you have rental real estate, royalties, partnerships, or S-corporations, these instructions assist you in reporting the income or loss.

Schedule SE Instructions: For taxpayers with self-employment income, these instructions explain how to calculate self-employment tax.

How to complete 2013 form 1040 instructions

To complete the 2013 form 1040 instructions, follow these steps:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other income or deduction-related paperwork.

02

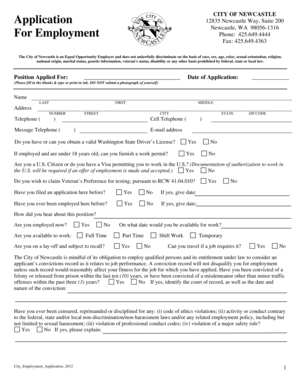

Fill out your personal information, including your name, address, and social security number.

03

Report your income from various sources, such as wages, interest, dividends, and self-employment earnings.

04

Deduct eligible expenses, such as mortgage interest, property taxes, and charitable contributions.

05

Calculate your tax liability and determine if you qualify for any tax credits.

06

Attach any required schedules, such as Schedule A for itemized deductions or Schedule SE for self-employment tax.

07

Double-check all the information entered to ensure accuracy.

08

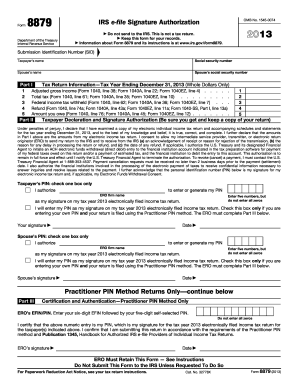

Sign and date the form before mailing it to the address provided in the instructions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Related templates