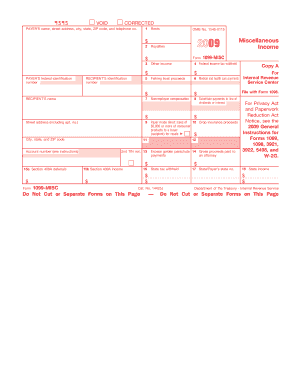

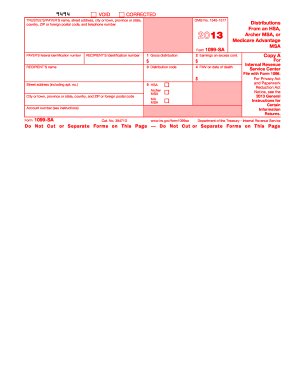

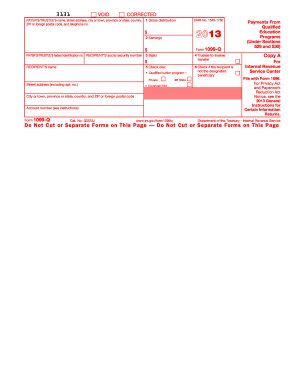

2013 Form 1099-misc

What is 2013 form 1099-misc?

The 2013 form 1099-misc is a tax document used to report income received in the year 2013 that is not from an employer-employee relationship. This form is typically used to report income earned through self-employment, as well as various other types of miscellaneous income such as rent, royalties, and awards or prizes.

What are the types of 2013 form 1099-misc?

There are several types of income that are reported on the 2013 form 1099-misc. Some of the common types include: 1. Non-employee compensation 2. Rent 3. Royalties 4. Prizes and awards 5. Medical and healthcare payments 6. Crop insurance proceeds 7. Fishing boat proceeds 8. Gross proceeds paid to an attorney 9. Substitute payments in lieu of dividends or interest 10. Debt cancellation These are just a few examples, and there may be additional types of income that need to be reported depending on individual circumstances.

How to complete 2013 form 1099-misc

Completing the 2013 form 1099-misc can be done in a few simple steps:

By following these steps, you can successfully complete the 2013 form 1099-misc and fulfill your tax reporting obligations.