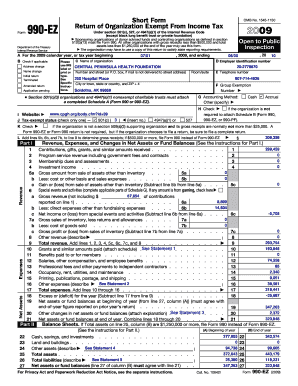

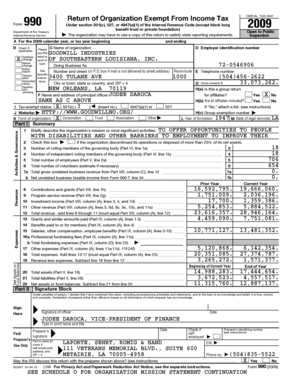

What is 501 c 3 tax exempt form?

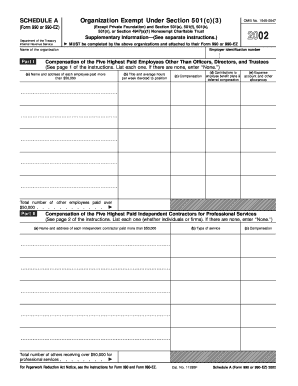

The 501(c)(3) tax exempt form is a document that organizations must file with the Internal Revenue Service (IRS) to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is used to demonstrate that the organization meets the requirements for being considered tax-exempt and eligible to receive tax-deductible donations.

What are the types of 501 c 3 tax exempt form?

There are three main types of 501(c)(3) tax exempt forms:

Form Application for Recognition of Exemption Under Section 501(c)(3)

Form 1023-EZ: Streamlined Application for Recognition of Exemption Under Section 501(c)(3)

Form Application for Recognition of Exemption Under Section 501(a)

How to complete 501 c 3 tax exempt form

Completing the 501(c)(3) tax exempt form requires careful attention to detail. Here is a step-by-step guide to help you navigate through the process:

01

Gather all the necessary documentation, including articles of incorporation, bylaws, and financial statements.

02

Read the instructions provided with the form carefully to understand the requirements and ensure you meet all the criteria.

03

Fill out the form accurately and provide all the required information.

04

Attach any supporting documents that are necessary to demonstrate your organization's eligibility for tax-exempt status.

05

Review the completed form and supporting documents to ensure they are error-free and organized.

06

Submit the form to the IRS along with the required fee, if applicable.

07

Wait for the IRS to process your application and communicate the decision to you.

08

Once approved, maintain your tax-exempt status by fulfilling all the ongoing filing and reporting requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.