What is form 1023 example?

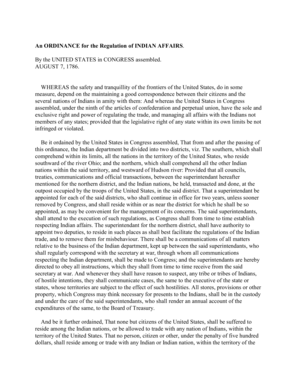

Form 1023 is an important document required by the Internal Revenue Service (IRS) for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form serves as an application for recognition of exemption and provides detailed information about the organization's purpose, activities, and financials. An example of form 1023 can be found on the IRS website, showcasing the structure and content required for successful completion.

What are the types of form 1023 example?

There are mainly three types of form 1023 examples based on the size and nature of the organization: Standard Form 1023, Form 1023-EZ, and Form 1023-A.

Standard Form This is the most comprehensive version of form 1023 and is suitable for organizations with complex structures or those expecting to have significant public support.

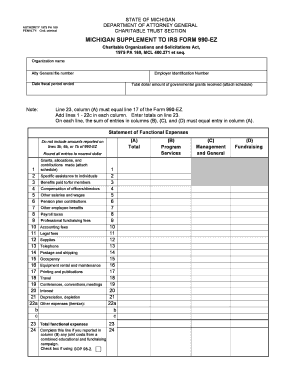

Form 1023-EZ: This streamlined version of form 1023 is available for small organizations with projected annual gross receipts of $50,000 or less and total assets of $250,000 or less. It simplifies the application process by requiring fewer details.

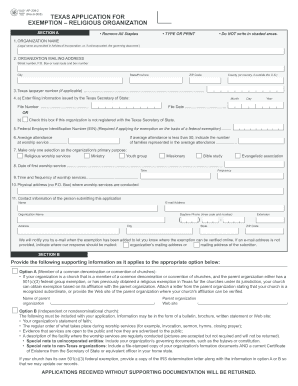

Form 1023-A: This form is used to request a determination letter of foundation status for a private foundation as defined in section 509(a) of the Internal Revenue Code. It has its unique set of requirements specific to private foundations.

How to complete form 1023 example

Completing form 1023 requires careful attention to detail and accurate information. Here are the key steps to complete the form successfully:

01

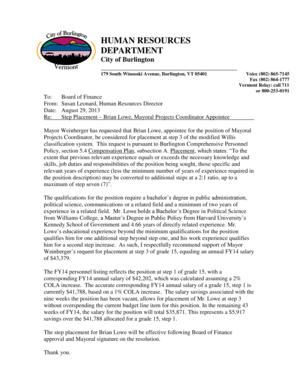

Gather all necessary information: Collect information about your organization's structure, purpose, activities, finances, and governing documents.

02

Follow instructions: Read the instructions provided by the IRS carefully to understand the requirements for each section of the form.

03

Fill out the form: Enter the required information accurately, ensuring consistency and completeness.

04

Attach supporting documents: Include any necessary attachments, such as financial statements, articles of incorporation, or bylaws.

05

Review and submit: Double-check all the entered information for any errors or omissions. Once reviewed, submit the completed form and required fee to the IRS for processing.

06

Track the application status: After submitting form 1023, you can track the status of your application using the IRS's online tracking tool or by contacting their helpline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.