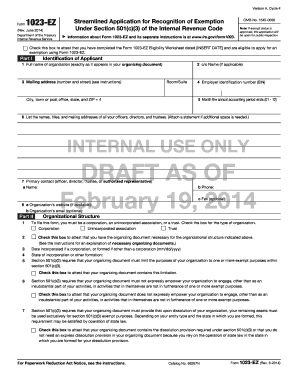

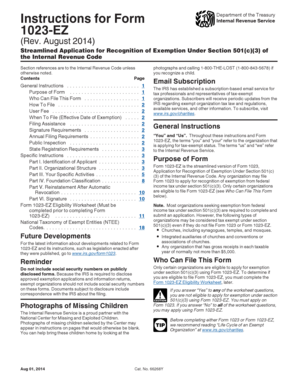

Irs Form 1023-ez

What is irs form 1023-ez?

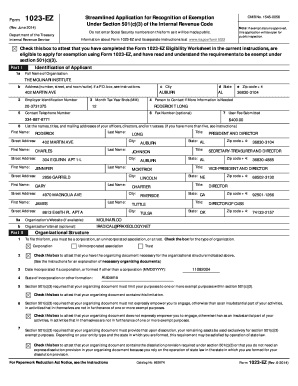

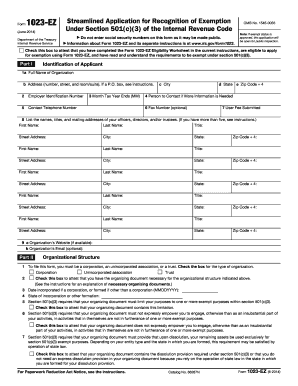

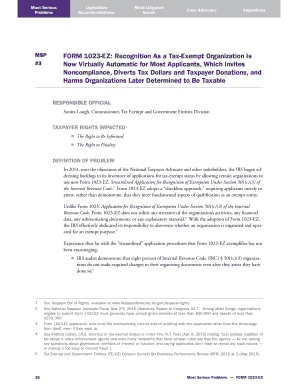

IRS Form 1023-EZ is a streamlined application form used by nonprofit organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is designed to simplify the process for smaller organizations with annual gross receipts less than $50,000 and total assets less than $250,000. It is an alternative to the longer and more complex Form 1023, allowing eligible organizations to apply for tax-exempt status more efficiently and with less paperwork.

What are the types of irs form 1023-ez?

There is only one type of IRS Form 1023-EZ, which is the streamlined application form for tax-exempt status under Section 501(c)(3). This form is specifically designed for smaller nonprofit organizations that meet certain eligibility criteria. It is important for organizations to determine if they qualify for the streamlined process before completing the form.

How to complete irs form 1023-ez

Completing IRS Form 1023-EZ involves several steps to ensure accuracy and compliance. Here is a step-by-step guide to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.