What is asset purchase agreement checklist?

An asset purchase agreement (APA) checklist is a comprehensive document that outlines the key elements and tasks involved in a transaction where one party acquires the assets of another party. This checklist helps both the buyer and the seller ensure that all necessary steps are taken and all important aspects are considered throughout the acquisition process.

What are the types of asset purchase agreement checklist?

There are several types of asset purchase agreement checklists that can be used depending on the specific circumstances of the transaction. Some common types include:

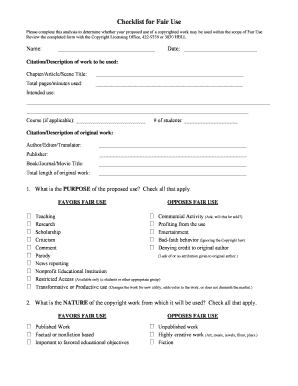

Due Diligence Checklist: This type of checklist helps the buyer assess the risks and opportunities associated with the assets being purchased. It includes tasks such as reviewing financial statements, contracts, permits, and other relevant documents.

Legal Checklist: This checklist focuses on legal aspects such as ensuring proper title transfer, compliance with laws and regulations, and any necessary licenses or permits.

Tax Checklist: This checklist helps the buyer identify and evaluate potential tax implications of the asset purchase. It includes tasks such as reviewing tax returns, identifying tax liabilities, and considering any tax planning strategies.

Operational Checklist: This checklist covers operational aspects such as transitioning employees, managing contracts with customers and suppliers, and any necessary adjustments to business processes.

How to complete asset purchase agreement checklist

Completing an asset purchase agreement checklist involves the following steps:

01

Review the checklist: Familiarize yourself with the checklist and understand the tasks and requirements listed.

02

Gather required documents: Collect all relevant documents and information needed to complete the checklist, such as financial records, legal documents, and tax information.

03

Assign responsibilities: Determine who will be responsible for each task and make sure there is clear communication and coordination among the involved parties.

04

Check off completed tasks: As you go through the checklist, mark off each completed task to track progress and ensure nothing is overlooked.

05

Review and revise: Regularly review and update the checklist as needed to reflect any changes or new developments in the acquisition process.

06

Seek professional assistance: Consider consulting with legal, financial, and tax advisors to ensure that the checklist is thorough and accurate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.