Balance Sheet Template Free

What is Balance Sheet Template Free?

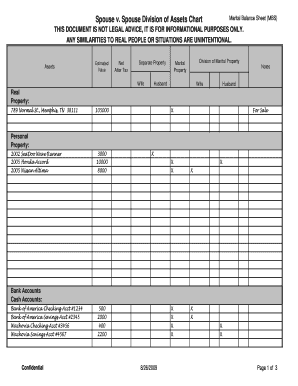

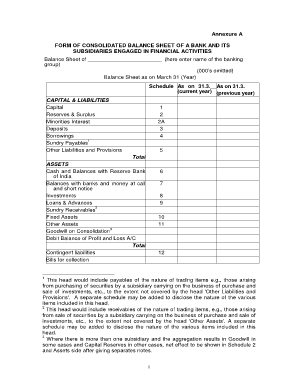

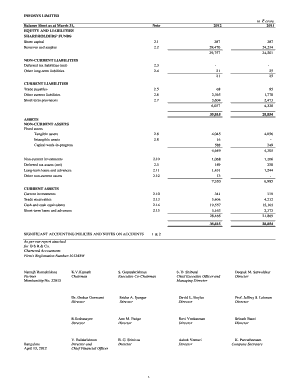

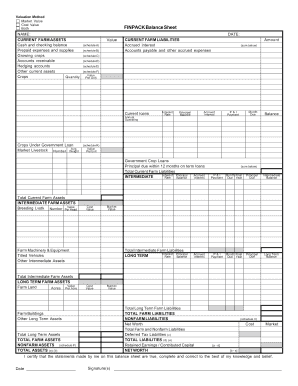

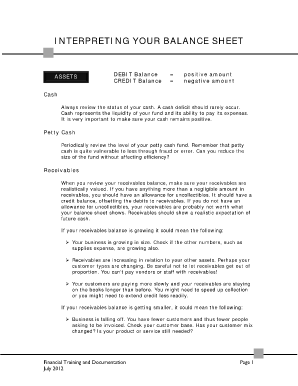

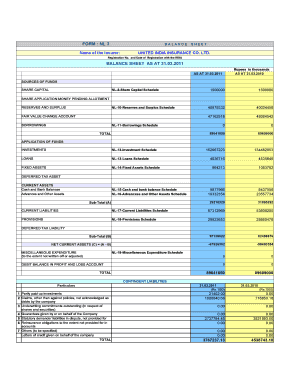

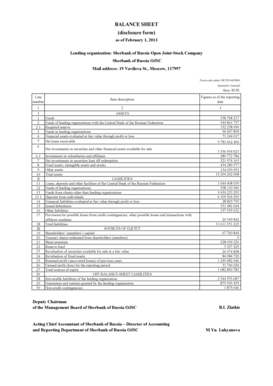

A Balance Sheet Template Free is a pre-designed document that helps individuals and businesses keep track of their financial position at a given point in time. It provides a structured format for organizing and presenting financial information, including assets, liabilities, and equity. By using a balance sheet template, users can easily calculate their net worth and analyze their financial health.

What are the types of Balance Sheet Template Free?

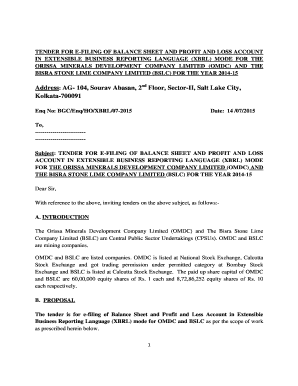

There are several types of Balance Sheet Template Free available, each tailored to different needs and preferences. Some common types include: 1. Basic Balance Sheet Template: This template provides a simple and straightforward layout for recording and calculating financial data. 2. Business Balance Sheet Template: Specifically designed for businesses, this template includes additional sections for income, expenses, and profit. 3. Personal Balance Sheet Template: Ideal for individuals, this template focuses on personal assets, liabilities, and net worth. 4. Projected Balance Sheet Template: This template allows users to forecast their financial position based on projected income and expenses. 5. Comparative Balance Sheet Template: This template enables users to compare their current balance sheet with previous periods to identify trends and changes.

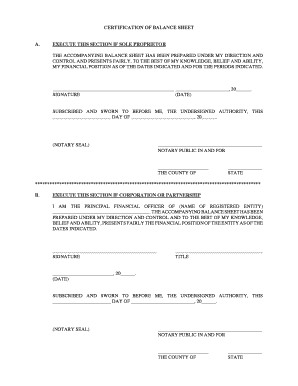

How to complete Balance Sheet Template Free

Completing a Balance Sheet Template Free is a straightforward process that requires a systematic approach. Follow these steps to complete the template effectively: 1. Gather all necessary financial documents, including bank statements, investment records, and loan statements. 2. Categorize your assets, liabilities, and equity sections based on the provided sections in the template. 3. Input the corresponding values for each item, ensuring accuracy and consistency. 4. Double-check all calculations to ensure they are correct and error-free. 5. Review the completed balance sheet to ensure it reflects your financial position accurately. 6. Save the balance sheet template for future reference or print it for physical records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.