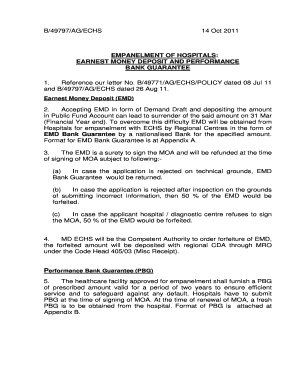

What is bank guarantee draft?

A bank guarantee draft is a legal document that outlines the terms and conditions of a guarantee provided by a bank on behalf of its customer. It serves as a commitment from the bank to pay a specified amount to the beneficiary if the customer fails to fulfill their obligations as agreed upon.

What are the types of bank guarantee draft?

There are several types of bank guarantee drafts depending on the purpose and requirements of the guarantee. Some common types include:

Bid Bond Guarantee: Ensures that a bidder will honor their obligation if selected for a project.

Performance Guarantee: Guarantees the satisfactory completion of a contract or project.

Advance Payment Guarantee: Provides assurance to the buyer that a supplier will refund an advance payment if agreed conditions are not met.

Payment Guarantee: Assures the seller that the buyer will fulfill their payment obligations.

Financial Guarantee: Guarantees financial compensation in case of default on a loan or debt.

How to complete bank guarantee draft

Completing a bank guarantee draft requires attention to detail and adherence to certain guidelines. Here are the steps to follow:

01

Begin by identifying the parties involved, including the beneficiary, applicant, and issuing bank.

02

Specify the purpose of the guarantee draft and provide necessary details such as the amount, expiration date, and any conditions or triggers for payment.

03

Include a clear description of the underlying contract or agreement for which the guarantee is being issued.

04

Provide any additional terms or clauses that may be required or agreed upon by the parties involved.

05

Review the draft thoroughly to ensure accuracy and completeness.

06

Obtain the necessary signatures and authorizations from all parties involved.

07

Submit the completed bank guarantee draft to the issuing bank for their review and approval.

With the help of pdfFiller, completing and managing bank guarantee drafts becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.