Business Mileage Tracking Log - Page 2

What is Business Mileage Tracking Log?

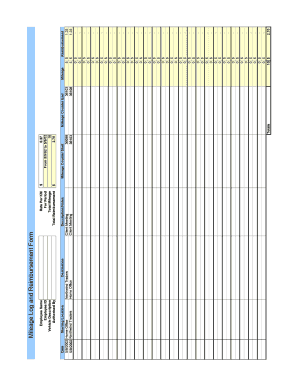

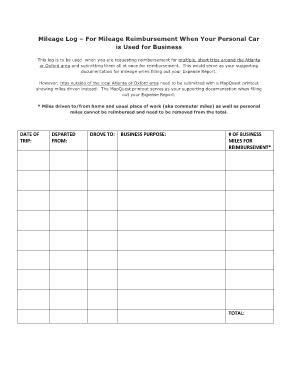

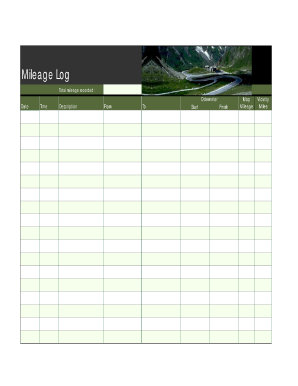

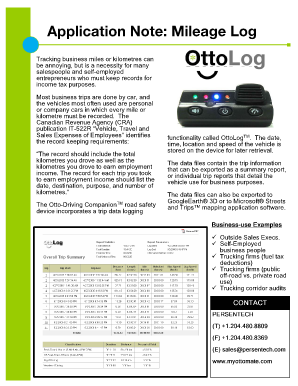

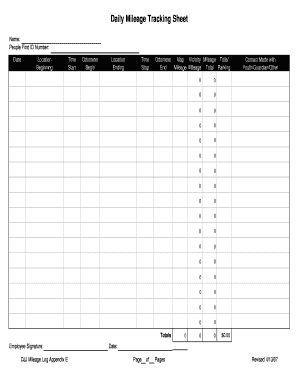

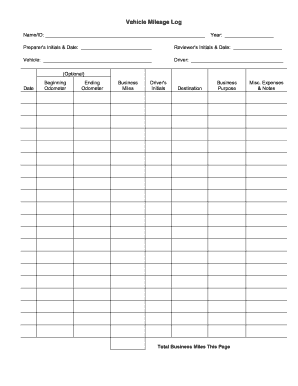

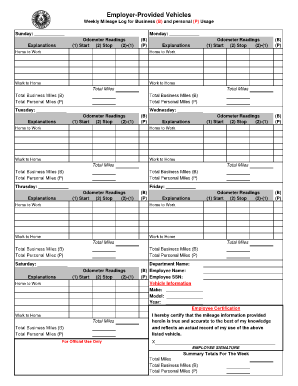

A Business Mileage Tracking Log is a document that helps individuals and businesses keep track of their mileage for tax, reimbursement, or other purposes. It records the starting and ending locations, dates, miles driven, and the purpose of each trip. This log is essential for accurate reporting and can help save money by maximizing eligible deductions.

What are the types of Business Mileage Tracking Log?

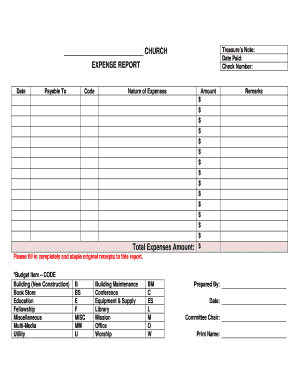

There are various types of Business Mileage Tracking Logs available based on individual or business needs. Some common types include:

How to complete Business Mileage Tracking Log

Completing a Business Mileage Tracking Log is a simple process that involves the following steps:

By using a comprehensive Business Mileage Tracking Log, individuals and businesses can ensure accurate and organized record-keeping, which can help in tax reporting, expense reimbursement, and overall financial management. pdfFiller empowers users to create, edit, and share their Business Mileage Tracking Logs online, offering unlimited fillable templates and powerful editing tools. It is the ultimate PDF editor that users need to efficiently manage their documents.