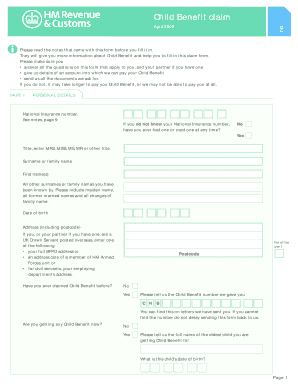

Child Benefit Claim Form

What is Child Benefit Claim Form?

The Child Benefit Claim Form is a document used to apply for financial assistance provided by the government to help with the cost of raising a child. It is a way for parents or guardians to claim benefits such as Child Benefit and Child Tax Credit.

What are the types of Child Benefit Claim Form?

There are two main types of Child Benefit Claim Form:

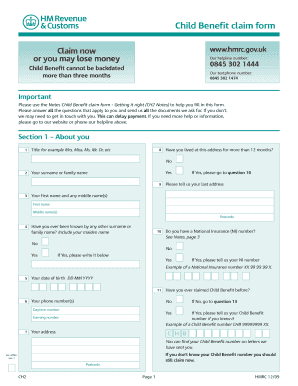

Form CHThis is the standard form used by most people to claim Child Benefit.

Form CH2 (CWF1): This is a special form used by individuals who are self-employed and also want to claim Child Benefit.

How to complete Child Benefit Claim Form

To complete the Child Benefit Claim Form, follow these steps:

01

Gather all necessary documents, such as your child's birth certificate and your National Insurance number.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide information about your child, such as their name, date of birth, and National Insurance number if available.

04

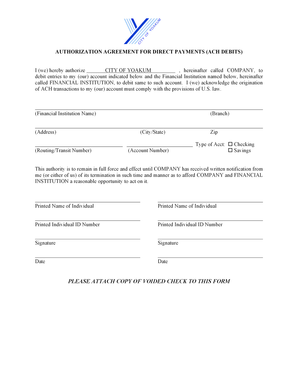

Specify your preferred payment method and provide relevant banking details.

05

Answer all questions about your employment status, income, and other relevant details.

06

Review the form for any errors or omissions before submitting it.

07

Sign and date the form.

08

Submit the completed form to the appropriate government office.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Child Benefit Claim Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much is the Canada Child Benefit 2022?

For the 2022–23 benefit year, families most in need can receive up to $6,997 per child under the age of six and $5,903 per child aged six through 17. The Canada Child Benefit was introduced in 2016 and is a key component of the Government of Canada's Affordability Plan.

How much is Child Benefit Canada?

Based on CCB payments in 2021, you could receive a maximum of: $6,833 per year ($569.41 per month) for each eligible child under the age of 6. $5,765 per year ($480.41 per month) for each eligible child aged 6 to 17.

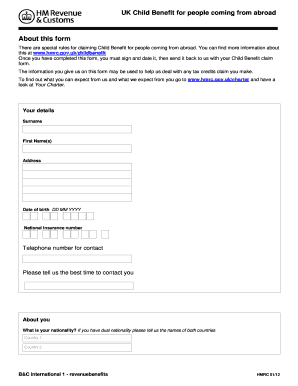

How do I claim Child Benefit UK?

Make a claim for the first time Fill in Child Benefit claim form CH2 and send it to the Child Benefit Office. The address is on the form. If your child is adopted, send their original adoption certificate with the form. You can order a new adoption certificate if you've lost the original.

How much does each child get for Child Benefit?

Updated for 2022-2023 The maximum benefit per child under 6 is $6,997 per year ($583.08 per month). The maximum benefit per child for children aged 6 to 17 is $5,903 per year ($491.91 per month).

Who is eligible for the child tax credit in 2022?

California: Families who earn less than $25,000 are eligible to receive $1,000, either as a reduced state tax bill or refund. Those earning between $25,000 and $30,000 would receive a reduced credit.

When can I claim Child Benefit?

You can claim Child Benefit at any time, but it's best to do it as soon as your child is born or comes to live with you. If you've just had a baby you need to register the birth before you claim.