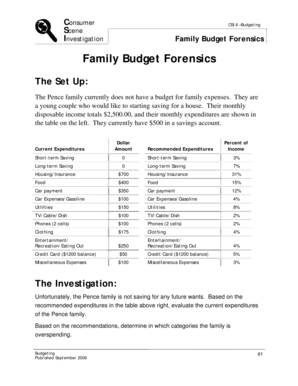

What is college student monthly budget?

A college student monthly budget refers to the amount of money that a college student sets aside for their expenses on a monthly basis. It includes all the necessary expenses such as rent, groceries, utilities, transportation, and any other costs related to their education and lifestyle.

What are the types of college student monthly budget?

There are several types of college student monthly budgets that students can consider based on their financial situation and goals. Some common types include:

Basic Budget: This type focuses on covering essential expenses like rent, food, and utilities.

Savings-Oriented Budget: This type emphasizes saving a certain percentage of income each month for future goals or emergencies.

Flexible Budget: This type allows for more flexibility and discretionary spending, but still includes a set amount for essentials.

Debt Repayment Budget: This type focuses on allocating a significant portion of income towards paying off student loans or other debts.

How to complete college student monthly budget

Completing your college student monthly budget is a straightforward process. Follow these steps to get started:

01

Determine your income: Calculate the total amount of money you have coming in each month. This can include part-time job earnings, scholarships, grants, or financial aid.

02

Track your expenses: Keep track of all your expenses for a month. This will help you understand where your money is going and identify areas where you can cut back.

03

Set financial goals: Determine what you want to achieve financially. It could be saving for a specific purchase, paying off debt, or building an emergency fund.

04

Create budget categories: Divide your expenses into categories such as rent, groceries, transportation, entertainment, and savings. Allocate a realistic amount of money to each category.

05

Monitor and adjust: Regularly review your budget and make adjustments as needed. Track your progress towards your financial goals and make changes to your spending habits if necessary.

By following these steps, you can effectively manage your college student monthly budget and make sure your expenses align with your financial goals. Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.