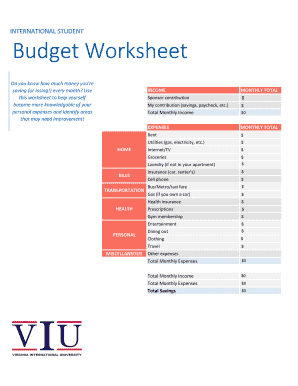

Student Budget Worksheet

What is student budget worksheet?

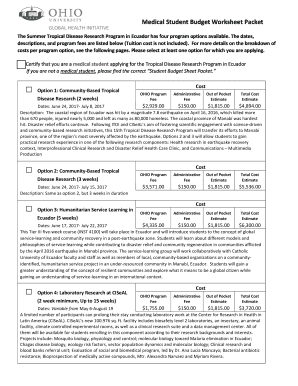

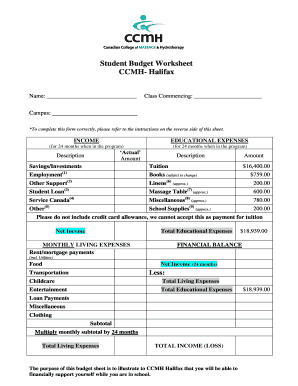

A student budget worksheet is a tool that helps students track their income and expenses. It is designed to help students manage their finances effectively and make informed decisions about their spending habits. By using a student budget worksheet, students can get a clear overview of their financial situation, set financial goals, and plan their expenses accordingly. It serves as a practical guide to help students stay on track with their budgets and avoid unnecessary financial stress.

What are the types of student budget worksheet?

There are several types of student budget worksheets available, depending on the specific needs and preferences of the student. Some common types include: 1. Monthly Expense Worksheet: This type of worksheet allows students to track their monthly expenses, such as rent, groceries, transportation, and entertainment. 2. Income Tracker Worksheet: This type of worksheet helps students keep track of their income sources, including part-time jobs, scholarships, and allowances. 3. Savings Goal Worksheet: This type of worksheet enables students to set savings goals and monitor their progress towards achieving them. 4. Debt Repayment Worksheet: This type of worksheet assists students in managing and paying off their student loans or any other debts they may have incurred. By choosing the right type of student budget worksheet, students can effectively manage their finances based on their specific needs and financial goals.

How to complete student budget worksheet

Completing a student budget worksheet is a straightforward process that can be done in a few simple steps: 1. Gather income and expense information: Collect all the relevant information about your income sources and expenses, including bank statements, receipts, and pay stubs. 2. Categorize your expenses: Break down your expenses into categories such as rent, groceries, transportation, entertainment, and education-related costs. 3. Enter the information into the worksheet: Using the chosen student budget worksheet, enter the income and expense information into the respective fields. 4. Calculate totals: Use the built-in formulas or functions in the worksheet to calculate the totals for each category, as well as the overall income and expenses. 5. Analyze and adjust: Review the completed worksheet to analyze your spending patterns and identify areas where you can make adjustments to stay within your budget. By following these steps, you can effectively complete a student budget worksheet and gain a better understanding of your financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.