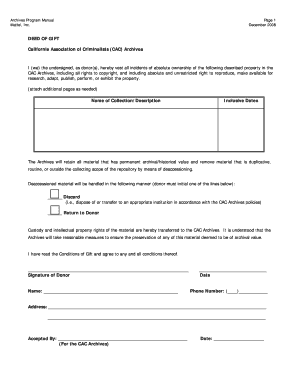

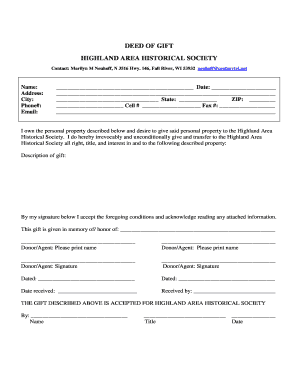

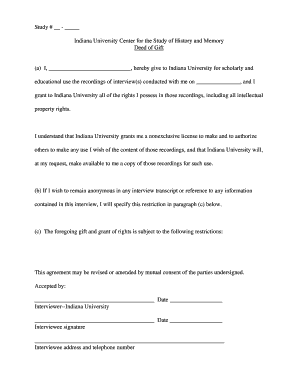

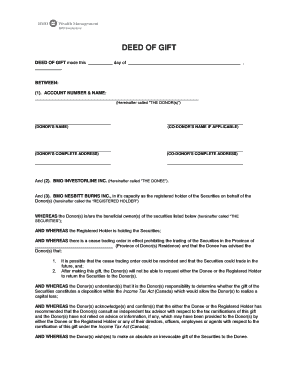

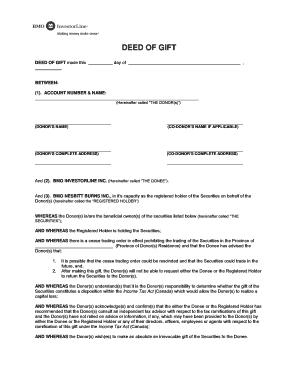

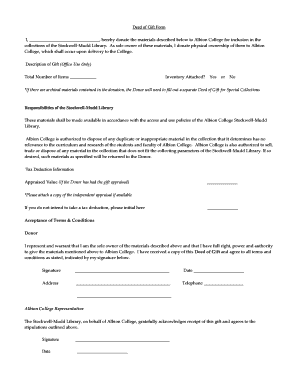

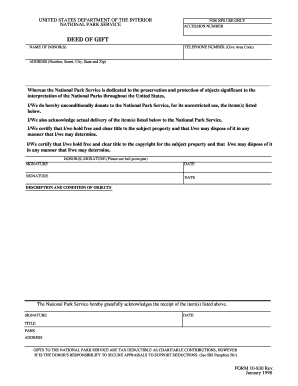

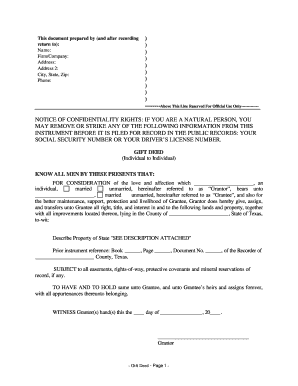

Deed Of Gift

What is Deed Of Gift?

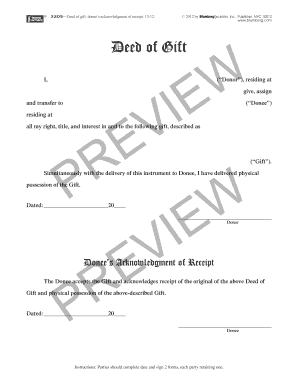

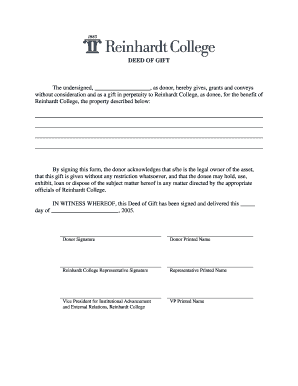

A Deed of Gift is a legal document that is used to transfer ownership of a property or asset from one party to another as a gift. It is a voluntary transfer of property without any consideration or payment involved.

What are the types of Deed Of Gift?

There are various types of Deed of Gift that can be used depending on the specific situation and nature of the gift. Some common types include:

Real estate Deed of Gift: This is used to transfer ownership of real property, such as land or a house, as a gift.

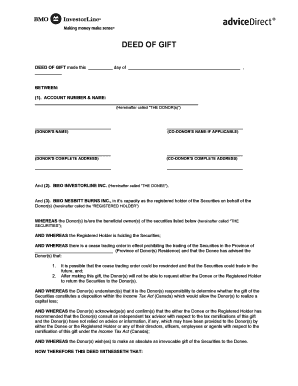

Financial Deed of Gift: This is used to transfer ownership of financial assets, such as stocks, bonds, or cash, as a gift.

Personal property Deed of Gift: This is used to transfer ownership of personal belongings, such as jewelry, artwork, or vehicles, as a gift.

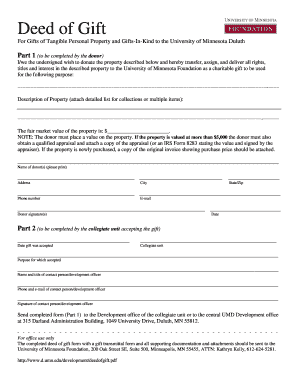

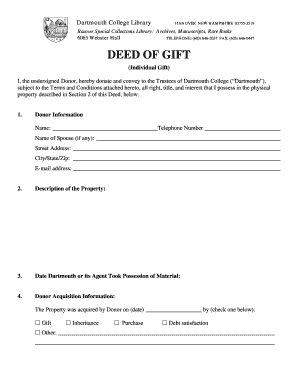

How to complete Deed Of Gift

Completing a Deed of Gift is a straightforward process. Here are the steps involved:

01

Identify the parties involved: Clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift).

02

Describe the gift: Provide a detailed description of the property or asset being gifted.

03

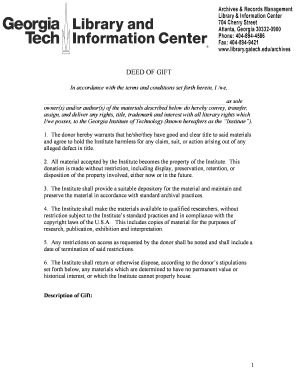

Include any conditions or restrictions: If there are any specific conditions or restrictions attached to the gift, make sure to include them in the deed.

04

Sign and date the deed: Both the donor and recipient should sign and date the document to make it legally binding.

05

Consider legal advice: It is recommended to consult with a legal professional to ensure that the deed is properly drafted and meets all legal requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Deed Of Gift

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I transfer property to a family member in Texas?

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

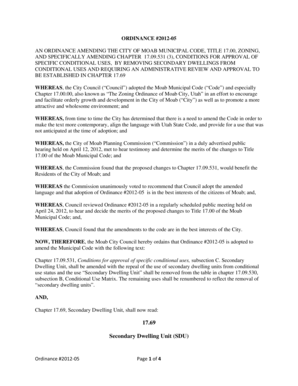

What is a deed of gift in Georgia?

Deed Of Gift. (Commercial Transaction) (GA) This deed of gift form is commonly used in Georgia to transfer title of real property between spouses, relatives, friends, or to charities. It can only be used when there is no compensation or consideration involved in the transaction.

How do I draft a gift?

Gift deed: How to draft it? Place and date on which the gift deed is to be executed. Relevant information on gift deed regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property for which you draft a gift deed.

How do you show a gift deed?

Acceptance by the Donee- The Gift Deed must mention the acceptance of the gifted property by the Donee. Witnesses- As the execution of a Gift Deed requires the presence of two witnesses, the Gift Deed must mention the name and address of the witnesses. A valid Gift deed must be signed and attested by two witnesses.

Do you have to pay taxes on a gift deed in Texas?

Gift deeds are not considered income. If the home is sold, the income is taxable. When a gift deed is created, it is important to know if you are subject to federal gift taxation for the home or property. If that taxation is not paid by the donor, the recipient is going to be responsible for that tax.

How do you make a gift deed?

Steps involved in the drafting of Gift Deed Date and Place where the deed is to be executed. Information about Donor and Donee like Name, Residential Address, Relationship among them, Date of Birth, etc. Details about the property. Two Witnesses. Signatures of Donor and Donee along with the witnesses.

Related templates