Deed Of Trust Form Nc

What is deed of trust form nc?

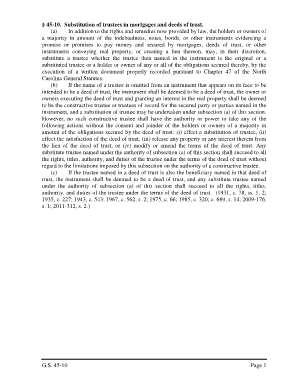

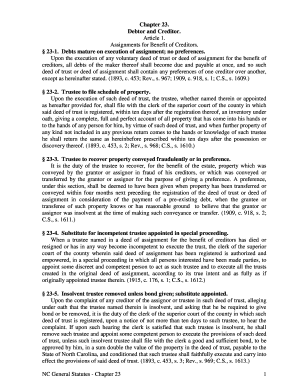

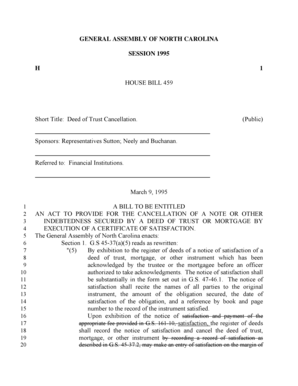

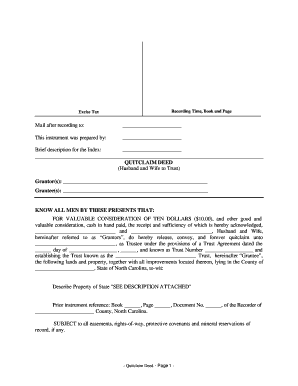

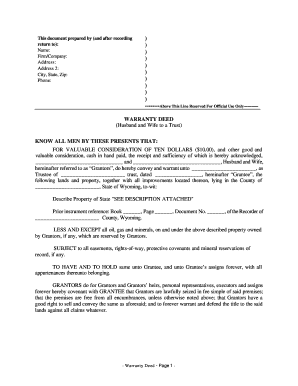

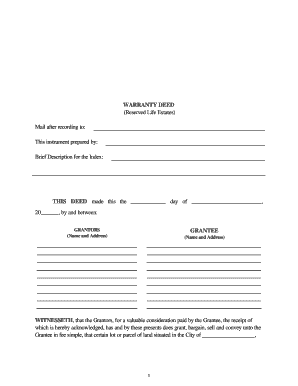

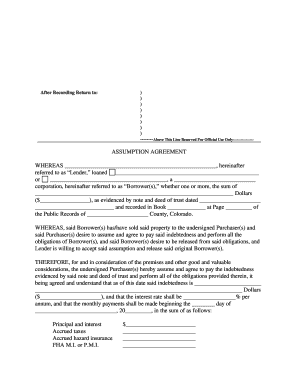

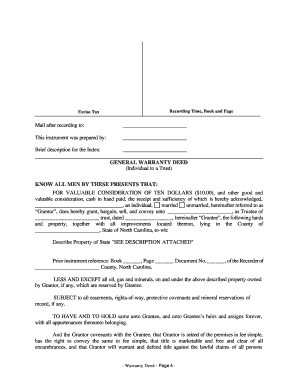

A deed of trust form in North Carolina, commonly known as a trust deed, is a legal document that outlines the terms and conditions of a loan secured by real estate. It functions as a security instrument, providing the lender with the ability to foreclose on the property in the event of default by the borrower. The deed of trust form nc typically includes details such as the names of the parties involved, the property description, the loan amount, the interest rate, and the repayment terms.

What are the types of deed of trust form nc?

In North Carolina, the most common types of deed of trust forms are the standard deed of trust form and the deed in lieu of foreclosure form. The standard deed of trust form is used when a borrower wants to secure a loan with real estate as collateral. On the other hand, the deed in lieu of foreclosure form is utilized when a borrower decides to voluntarily transfer the ownership of the property to the lender to avoid foreclosure.

How to complete deed of trust form nc

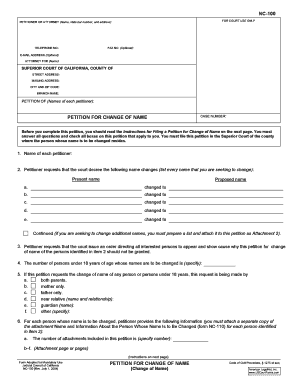

Completing the deed of trust form in North Carolina is a straightforward process. Here are the steps to follow:

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to get your documents done efficiently and effectively.