Deed Of Trust Form Oregon

What is deed of trust form oregon?

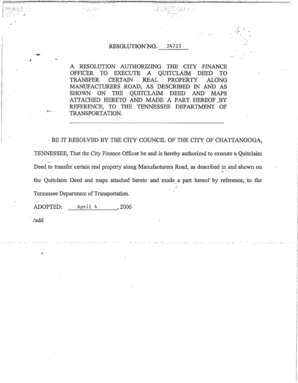

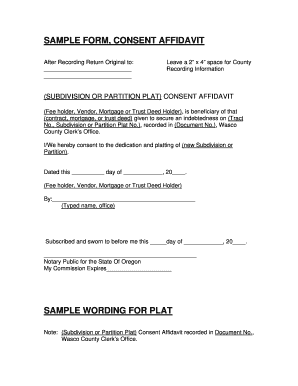

A deed of trust form in Oregon is a legal document that is used in real estate transactions to secure a loan on a property. It is similar to a mortgage, but the deed of trust involves three parties: the borrower, the lender, and the trustee. The borrower transfers the legal title of the property to the trustee, who holds it as security for the lender until the loan is repaid. If the borrower fails to repay the loan, the trustee can sell the property to satisfy the debt.

What are the types of deed of trust form oregon?

In Oregon, there are several types of deed of trust forms that may be used depending on the specific circumstances of the transaction. Some common types include:

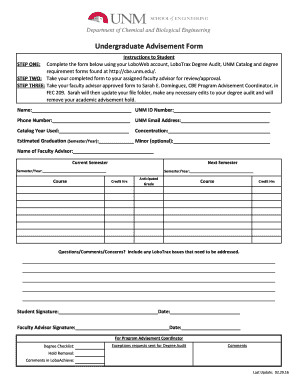

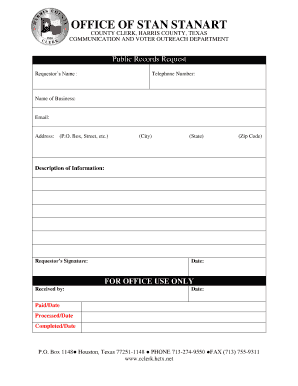

How to complete deed of trust form oregon

Completing a deed of trust form in Oregon requires attention to detail and accuracy. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.