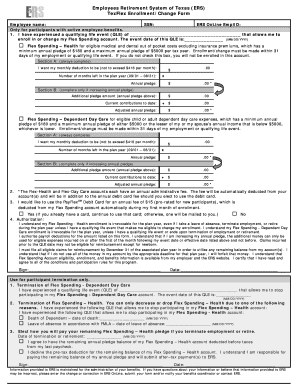

Employee Payroll Deduction Authorization Form

What is Employee Payroll Deduction Authorization Form?

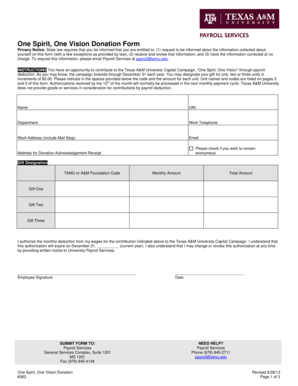

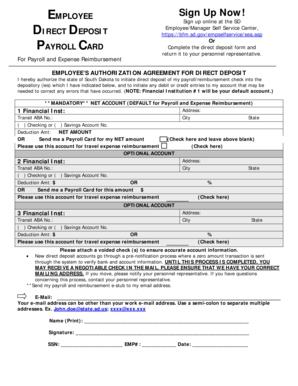

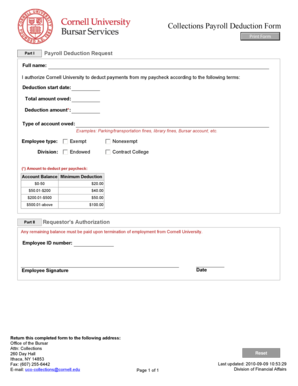

An Employee Payroll Deduction Authorization Form is a document that allows an employee to authorize their employer to deduct specific amounts from their wages or salary. This form is typically used for various purposes, such as voluntary deductions for benefits or retirement contributions, loan repayments, or wage garnishments.

What are the types of Employee Payroll Deduction Authorization Form?

There are several types of Employee Payroll Deduction Authorization Forms, including but not limited to:

Benefit Deduction Authorization Form

Retirement Contribution Authorization Form

Loan Repayment Authorization Form

Wage Garnishment Authorization Form

How to complete Employee Payroll Deduction Authorization Form

To complete an Employee Payroll Deduction Authorization Form, follow these steps:

01

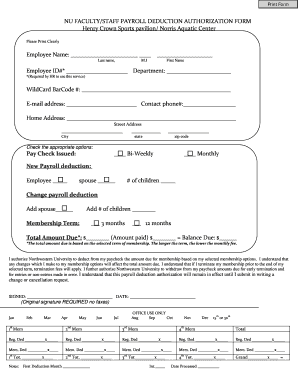

Fill in your personal information, such as your name, employee ID, and contact details.

02

Specify the type of deduction and the amount you authorize to be deducted from your salary or wages.

03

Provide any required supporting documentation, if applicable.

04

Review the form meticulously to ensure accuracy and completeness.

05

Sign and date the form.

06

Submit the form to the appropriate department or person responsible for handling payroll.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Employee Payroll Deduction Authorization Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is payroll authorization?

Payroll Authorization means a Participant's written authorization to withhold from his wages, specified percentages which shall be as either a Salary Deferral Contribution or Matched Voluntary Contribution or Nonmatched Voluntary Contribution contributed to this Plan on his behalf. Sample 1Sample 2.

What is a payroll deduction authorization form?

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What does payroll deduction mean?

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax.

How do I do payroll deductions?

How to calculate payroll deductions Adjust gross pay by withholding pre-tax contributions to health insurance, 401(k) retirement plans and other voluntary benefits. Refer to the employee's Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax.

What is Authorised deduction?

Authorized Deduction means those items set forth in each Application, or other authorization, that a Settlement Products Client authorizes the Originator, or a servicer on behalf of the Originator, to deduct from its Deposit Account.

What are three examples of payroll deductions?

Examples of payroll deductions include federal, state, and local taxes, health insurance premiums, and job-related expenses.

Related templates