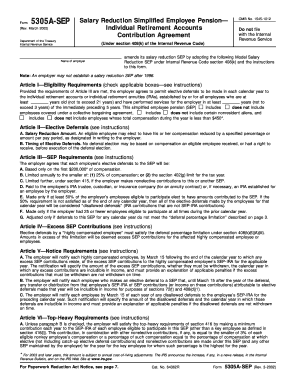

5305A-SEP Form

What is 5305A-SEP Form?

The 5305A-SEP Form is a document used by employers to establish a Simplified Employee Pension (SEP) plan. This form is provided by the Internal Revenue Service (IRS) and is used by employers to outline the terms and conditions of the SEP plan. It contains information regarding employee contributions, employer contributions, and other important details related to the retirement plan.

What are the types of 5305A-SEP Form?

There is only one type of 5305A-SEP Form available. This form is specifically designed for employers who want to establish a Simplified Employee Pension (SEP) plan for their employees. It provides a standardized format for employers to outline the details of the SEP plan and ensures compliance with IRS regulations.

How to complete 5305A-SEP Form

Completing the 5305A-SEP Form is a straightforward process. Follow the steps below to ensure accurate and complete submission of the form:

pdfFiller is a trusted online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users looking to streamline their document management process and ensure compliance with IRS regulations.