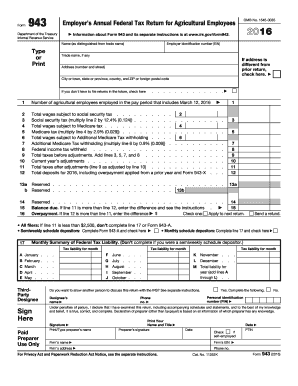

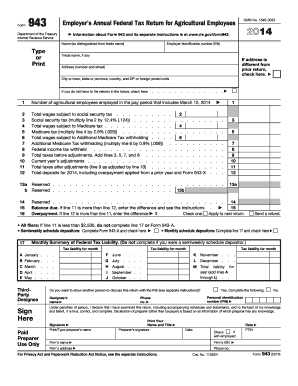

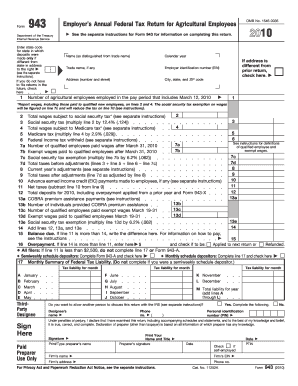

943 Form

What is 943 Form?

The 943 Form, also known as the Employer's Annual Federal Tax Return for Agricultural Employees, is a document used by employers to report wages and taxes for agricultural workers. This form is submitted to the Internal Revenue Service (IRS) at the end of each calendar year.

What are the types of 943 Form?

There are primarily two types of 943 Forms: 1. Form 943 - This is the standard form used by most employers with agricultural workers to report wages, taxes, and any adjustments. 2. Form 943-X - This form is used to correct any errors or make changes to a previously filed Form 943.

How to complete 943 Form

Completing the 943 Form is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.