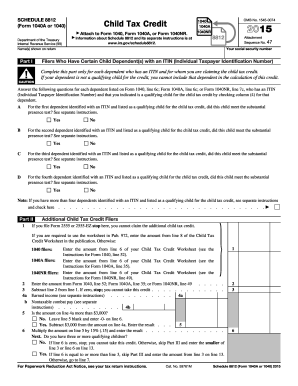

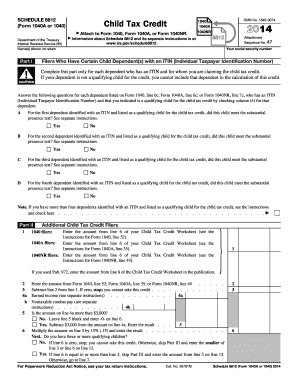

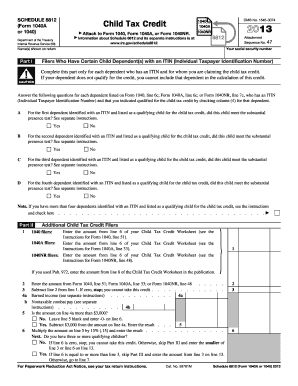

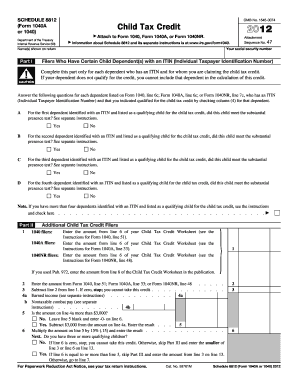

1040 Schedule 8812

What is 1040 Schedule 8812?

Understanding 1040 Schedule 8812 is crucial for taxpayers who qualify for the Child Tax Credit. This schedule is used to determine the additional Child Tax Credit that can be claimed if the amount of Child Tax Credit exceeds the taxpayer's tax liability. Essentially, 1040 Schedule 8812 helps families with eligible children to potentially receive further tax benefits.

What are the types of 1040 Schedule 8812?

There are two main types of 1040 Schedule 8812. The first type is for those who have a qualifying child, and the second type is for those who do not have a qualifying child. The requirements and calculations differ between the two types, so it is important to understand which category you fall into when completing the schedule.

How to complete 1040 Schedule 8812

Completing 1040 Schedule 8812 may seem complex at first, but with the right guidance, it can be done accurately. Here is a step-by-step guide to help you complete this schedule:

pdfFiller provides a convenient solution for taxpayers looking to streamline their document management. With pdfFiller, you can easily create, edit, and share your documents online. Offering a wide range of fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor to help you get your documents done efficiently.