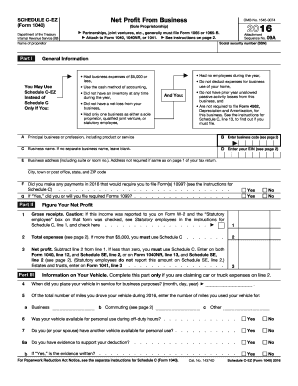

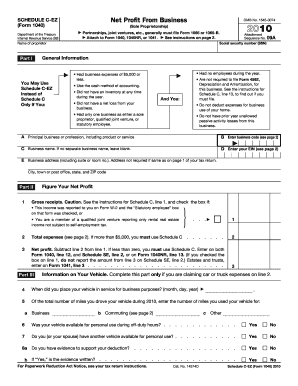

1040 Schedule C - EZ

What is 1040 Schedule C - EZ?

The 1040 Schedule C - EZ is a simplified version of the regular Schedule C form used by self-employed individuals to report their business income and expenses. It is designed specifically for small businesses with minimal expenses and revenue. By using the Schedule C - EZ, you can save time and effort when filing your taxes.

What are the types of 1040 Schedule C - EZ?

There is only one type of 1040 Schedule C - EZ form, which is the simplified version. This version is suitable for self-employed individuals who meet certain criteria, such as having a net profit of $5,000 or less, not having employees, not operating a home office, and not having inventory or depreciation expenses. If you meet these requirements, you can use the 1040 Schedule C - EZ to report your business income and expenses.

How to complete 1040 Schedule C - EZ

Completing the 1040 Schedule C - EZ is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.