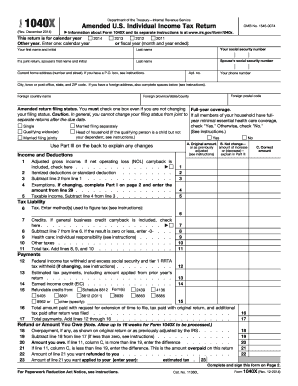

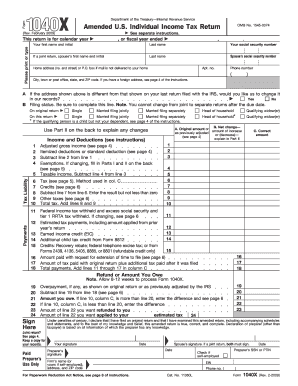

1040X Form

What is 1040X Form?

The 1040X Form, also known as the Amended U.S. Individual Income Tax Return, is a document used to correct errors or make changes to a previously filed tax return. It allows taxpayers to update their tax information if they have discovered mistakes or if certain circumstances have changed since filing their original return. By completing the 1040X Form, taxpayers can ensure their tax records are accurate and up to date.

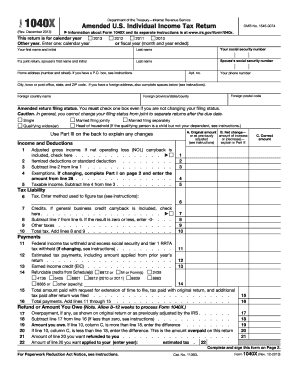

What are the types of 1040X Form?

There is only one type of 1040X Form, which is the Amended U.S. Individual Income Tax Return. This form is used by individuals who need to amend their federal tax return. Whether you need to correct a simple mistake or make significant changes to your tax information, the 1040X Form is the appropriate document to use.

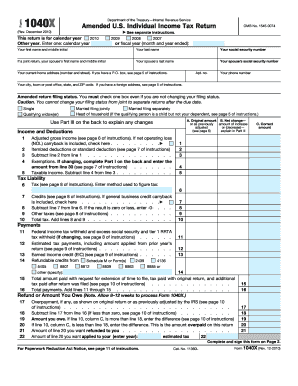

How to complete 1040X Form

Completing the 1040X Form may seem intimidating, but with the right guidance, it can be a straightforward process. Here are the basic steps to complete the form:

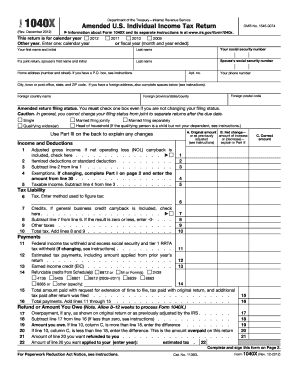

With pdfFiller, you can simplify the process even further. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done easily and efficiently.