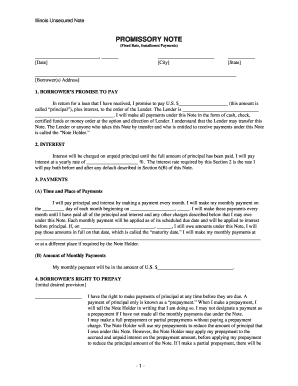

Fillable Pdf Promissory Note

What is a fillable pdf promissory note?

A fillable PDF promissory note is a legally binding document that outlines the terms of a loan agreement between two parties. It specifies the amount borrowed, the interest rate (if any), the repayment schedule, and the consequences for defaulting on the loan.

What are the types of fillable pdf promissory note?

There are several types of fillable PDF promissory notes that can be used depending on the specific loan agreement. Some common types include:

Fixed-Rate Promissory Note

Variable-Rate Promissory Note

Secured Promissory Note

Unsecured Promissory Note

How to complete a fillable pdf promissory note

Completing a fillable PDF promissory note is a straightforward process that can be done in a few simple steps:

01

Open the fillable PDF promissory note template using a PDF editor like pdfFiller.

02

Fill in the required fields with the relevant information, such as the borrower's and lender's details, loan amount, and repayment terms.

03

Review the completed document for accuracy and completeness.

04

Save the filled-out form and share it with the other party involved in the loan agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the rules of promissory note?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What is a promissory note explain?

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

How do I fill out a promissory note form?

How to Write a Promissory Note Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

What are three types of promissory notes?

Types of Promissory Notes Simple promissory note. Demand promissory note. Secured promissory note. Unsecured promissory note.

What is a simple promissory note?

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

What is the format of promissory note?

Detailed Information – The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Related templates