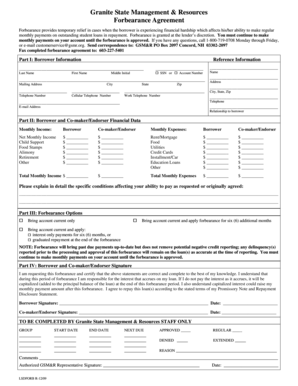

Forbearance Agreement Student Loan

What is forbearance agreement student loan?

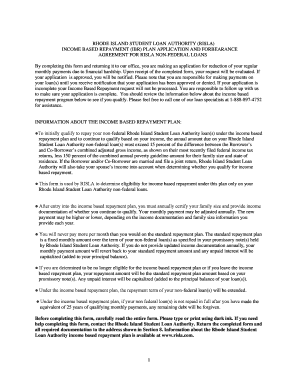

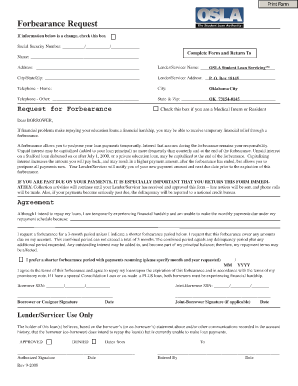

A forbearance agreement is a type of student loan agreement that allows borrowers to temporarily suspend or reduce their loan payments. It is usually granted to borrowers who are experiencing financial hardship and are unable to make their monthly payments. During forbearance, interest may still accrue on the loan, but the borrower is not required to make any payments. This agreement helps borrowers manage their loan obligations during difficult times and provides temporary relief from the financial burden of student loan payments.

What are the types of forbearance agreement student loan?

There are several types of forbearance agreement options available for student loans. These include: 1. General Forbearance: This is the most common type of forbearance and is available to borrowers who are experiencing financial hardship. 2. Mandatory Forbearance: This type of forbearance is granted to borrowers who meet specific criteria, such as serving in a medical or dental internship, participating in a residency program, or qualifying for the Department of Defense student loan repayment program. 3. Teacher Loan Forgiveness Forbearance: This forbearance option is available to teachers who qualify for the Teacher Loan Forgiveness program. 4. Post-Active Duty Student Deferment (PADSD): This option is available to active duty military members who recently completed their service and are returning to school. It provides temporary relief from loan payments during the transition period.

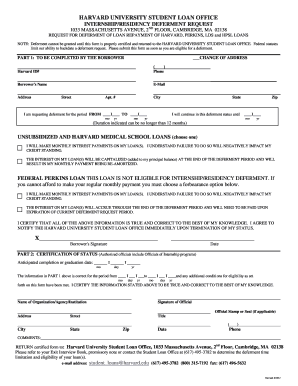

How to complete forbearance agreement student loan

Completing a forbearance agreement for a student loan involves several steps. Here is a simple guide to help you through the process: 1. Contact your loan servicer: Reach out to your loan servicer to discuss your financial situation and request a forbearance agreement. 2. Provide necessary documentation: Your loan servicer may ask for documents to support your request, such as proof of financial hardship or eligibility for a specific forbearance type. 3. Fill out the required forms: Your loan servicer will provide you with the necessary forms to complete the forbearance agreement. Make sure to accurately fill out all the required information. 4. Submit the forms: Once you have completed the forms, submit them to your loan servicer along with any requested documentation. 5. Follow up: Stay in touch with your loan servicer to ensure that your forbearance request is being processed. Keep track of any correspondence, confirmation numbers, or important dates. Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.