Forbearance Finance - Page 2

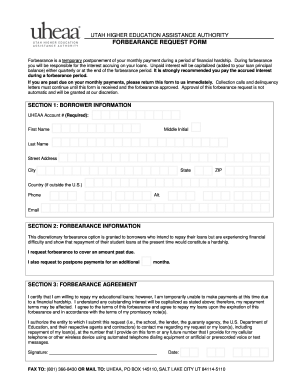

What is forbearance finance?

Forbearance finance refers to the temporary suspension or reduction of loan payments that a lender may grant to a borrower facing financial hardship. It is an agreement between the lender and the borrower to provide relief and allow the borrower to catch up on missed payments over a specified period of time.

What are the types of forbearance finance?

There are several types of forbearance finance options available depending on the lender and the borrower's situation. Some common types include: 1. Payment reduction: The lender may reduce the borrower's monthly payments for a certain period. 2. Interest-only payments: The borrower may be allowed to make only interest payments for a specified time. 3. Loan extension: The lender may extend the loan term to provide the borrower with more time to repay. 4. Temporary suspension: The lender may temporarily suspend the borrower's payments.

How to complete forbearance finance

Completing forbearance finance requires a few steps to ensure a successful agreement between the lender and the borrower: 1. Contact the lender: Reach out to the lender as soon as financial difficulties arise to discuss forbearance options. 2. Provide documentation: Prepare and submit any necessary documentation that the lender may require to assess eligibility. 3. Understand the terms: Review the terms of the forbearance agreement, including the duration, payment adjustments, and any additional fees. 4. Communicate regularly: Maintain open communication with the lender throughout the forbearance period to address any concerns or update financial circumstances. 5. Resume regular payments: Once the forbearance period ends, resume making regular payments as determined by the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.