Form 540 Instructions 2016

What is form 540 instructions 2016?

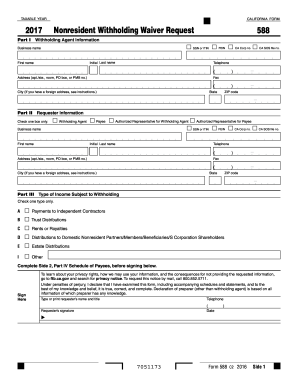

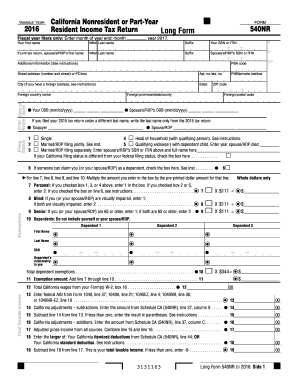

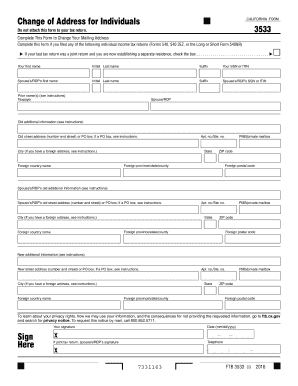

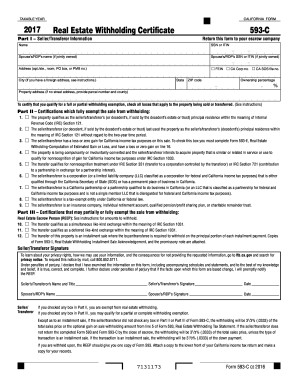

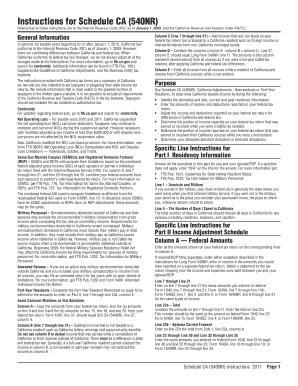

Form 540 instructions 2016 refers to the guidelines provided by the Internal Revenue Service (IRS) for completing and filing Form 540, which is used by individual taxpayers in California to report their state income taxes. These instructions outline the various sections and fields of the form and provide explanations and examples to help taxpayers accurately report their income, deductions, and credits for the tax year 2016.

What are the types of form 540 instructions 2016?

The types of Form 540 instructions 2016 include:

General instructions: This section provides an overview of Form 540 and its purpose. It explains who needs to file the form, the due dates, and other general information.

Specific instructions: This section provides detailed instructions for each line and field of the form. It explains what information to enter and how to calculate various aspects of income, deductions, and credits.

Additional forms and schedules: This section provides information on any additional forms and schedules that may be required to be filed along with Form It explains when and how to attach these forms and schedules to the main form.

How to complete form 540 instructions 2016

To complete form 540 instructions 2016, follow these steps:

01

Gather all the necessary documents and information, such as your W-2 forms, 1099 forms, and any other relevant documents that show your income and deductions.

02

Read the general instructions section of the form to understand the requirements and eligibility criteria for filing.

03

Follow the specific instructions for each line and field of the form. Enter the required information and calculate the amounts accurately.

04

If applicable, complete and attach any additional forms and schedules as instructed in the additional forms and schedules section.

05

Review the completed form and all attachments for accuracy and completeness.

06

Sign and date the form, and retain a copy for your records.

07

File the form by the due date, either electronically or by mail, as specified in the instructions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 540 instructions 2016

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I file a 540 amended return?

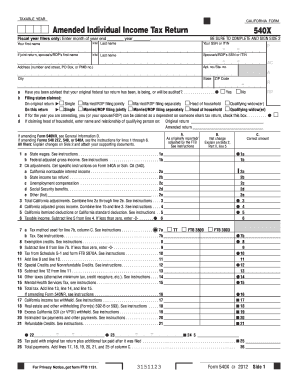

Option 1: Sign into your eFile.com account, modify your Return and download/print your updated CA Form 540/540NR under My Account. Then, complete Schedule X (amended return explanation). Attach Schedule X to your updated Form 540/540NR, sign the amended return and mail it to one of the addresses listed below.

Where do I file form 540 in California?

Personal FormWithout paymentWith payment540 540 2EZ 540NR Schedule XFranchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001540 (Scannable)Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001 Sep 22, 2021

Do I need to attach 1040 to ca 540?

California Franchise Tax Board requires the federal return to be attached to the California return as follows: Form 540: Federal return is required if federal return includes supporting forms or schedules other than Schedule A or Schedule B.

Where do I file my California tax return 540?

Personal FormWithout paymentWith payment540 540 2EZ 540NR Schedule XFranchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001540 (Scannable)Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001 Sep 22, 2021

How do I file form 540?

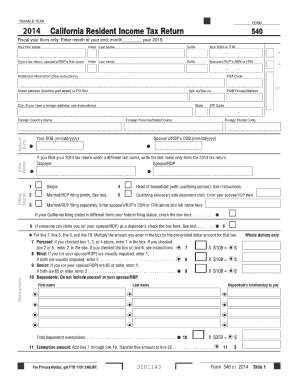

When filing Form 540, you must send all five sides to the Franchise Tax Board (FTB). Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1.

Where do I send my California Franchise Tax Board?

Individuals Include a copy of your notice, bill, or payment voucher. Make your check, money order, or cashier's check payable to Franchise Tax Board. Write either your FTB ID, SSN, or ITIN, and tax year on your payment. Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.

Related templates