Gmu Payroll

What is gmu payroll?

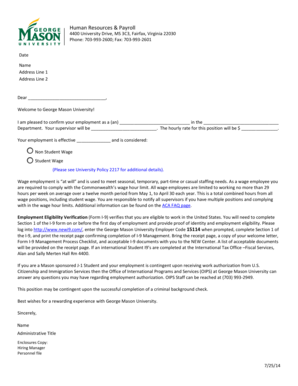

GMU payroll refers to the system and process used by George Mason University to manage and administer employee wages and benefits. It includes tracking hours worked, calculating salaries, deducting taxes and other withholdings, and issuing payments to employees. The payroll system ensures that employees are accurately compensated for their work and that all necessary taxes and deductions are properly accounted for.

What are the types of gmu payroll?

GMU offers several types of payroll to meet the needs of its diverse workforce. The types of GMU payroll include: 1. Regular payroll: This is the standard payroll for salaried employees who work a set number of hours per pay period. 2. Temporary payroll: This is used for employees who are hired on a temporary basis for a specific duration or project. 3. Student payroll: Designed for students who work part-time on campus. 4. Faculty payroll: Specifically for faculty members who teach at GMU. 5. Supplemental payroll: Used for additional payments to employees, such as bonuses or overtime. Each type of payroll has its own specific requirements and regulations that must be followed to ensure accurate processing and payments.

How to complete gmu payroll

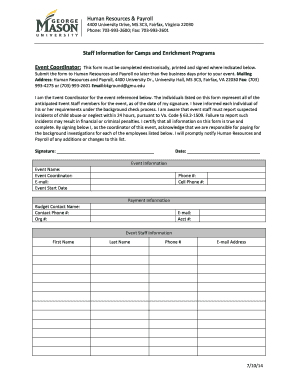

Completing GMU payroll involves several steps to ensure accurate and timely payments to employees. Here is a general guide on how to complete GMU payroll: 1. Obtain employee timesheets or work records: Collect the necessary documentation that records the hours worked by each employee. 2. Calculate wages and deductions: Use the provided payroll system or software to calculate wages based on the hours worked and applicable deductions, such as taxes and benefits. 3. Review and verify payroll data: Double-check all entered information for accuracy and completeness. Make any necessary adjustments. 4. Process payroll: Submit the finalized payroll data to the payroll department or system for processing. Ensure all necessary approvals are obtained. 5. Distribute pay: Once the payroll is processed, distribute the pay to employees through direct deposit or physical checks. By following these steps, GMU can ensure that employees are paid correctly and in a timely manner.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.