Gst Invoice Template

What is gst invoice template?

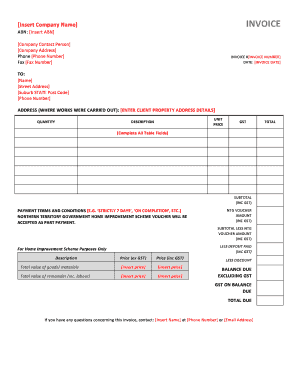

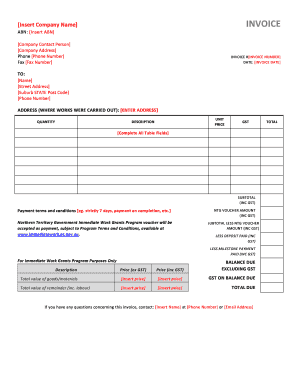

A GST invoice template is a pre-designed format that helps businesses to generate invoices for goods or services sold. It includes all the necessary details required by the Goods and Services Tax (GST) system, such as the seller's details, buyer's details, item description, quantities, rates, and applicable taxes.

What are the types of gst invoice template?

There are several types of GST invoice templates available to cater to different business needs. Some common types include:

Standard GST invoice template: This is the basic invoice format that includes all the essential information required by the GST system.

Tax invoice template: This type of invoice is used when a business is registered under GST and is required to charge taxes on the supply of goods or services.

Export invoice template: This invoice format is used when a business exports goods or services and includes additional details required for international transactions.

Bill of supply template: In cases where GST is not applicable, such as for exempted goods or services, a bill of supply template is used to document the transaction.

How to complete gst invoice template

Completing a GST invoice template is relatively straightforward. Here are the steps to follow:

01

Enter your business information: Include your business name, address, and contact details at the top of the invoice.

02

Add customer details: Provide the buyer's name, address, and GSTIN (if applicable) below your business information.

03

Itemize products or services: Fill in the details of each item sold, including the description, quantity, unit price, and applicable taxes.

04

Calculate totals: Calculate the subtotal, any applicable taxes, and the final total amount payable by the buyer.

05

Include payment terms and methods: Specify the payment terms, such as due date and accepted payment methods.

06

Add any additional information: If there are any special instructions or terms related to the transaction, include them in the invoice.

07

Review and finalize: Double-check all the information entered, make any necessary revisions, and then finalize the invoice for sending.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out gst invoice template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I GST an invoice in Excel?

Here are the steps you need to follow to create GST invoice using excel: Open Microsoft Excel. Remove Gridlines. Upload Company Logo and Heading. Add Company Details. Add Customer Details. Add Other Details. Enter Details of Goods and Services. Provide Bank Details.

Can I create my own invoice?

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.

What is the structure of an invoice?

The client's name and contact information. The invoice number, the date it was issued and the due date for payment. An itemized breakdown of the services and/or products provided. The invoice summary, including the subtotal, any taxes added and the total.

What is the format of GST invoice?

All GST invoices must be prepared in triplicate in case of supply of goods. The original copy should be marked as Original for Recipient. The duplicate copy should be marked as Duplicate for Transporter and the triplicate copy should be marked as Triplicate for Supplier.

What is GST bill with example?

GST invoice is a bill or receipt of items sent or services that a seller or service provider offers to a customer. It specifically lists out the services/products, along with the total amount due. One can check a GST invoice to determine said product or service prices before CGST and SGST are levied on them.

How do I create a GST sheet in Excel?

Steps to use GSTR 1 Excel Templates After submitting your Email id, download GSTR 1 files from your Inbox. Export data from your accounting software & create excel files. Fill data in ClearTax Standard Excel Templates. Import templates into ClearTax GST, your GSTR 1 will be auto-prepared.

Related templates