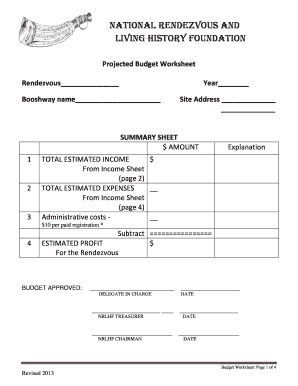

What is Holiday Budgeting Worksheet?

A Holiday Budgeting Worksheet is a tool that allows individuals or families to track and manage their expenses during the holiday season. It helps to ensure that you stay within your budget and avoid overspending. By using a Holiday Budgeting Worksheet, you can plan your holiday expenses in advance and keep track of how much you're spending on gifts, decorations, travel, and other holiday-related expenses.

What are the types of Holiday Budgeting Worksheet?

There are several types of Holiday Budgeting Worksheets available, each designed to meet different needs and preferences. Some common types include:

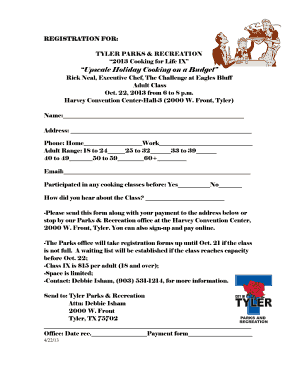

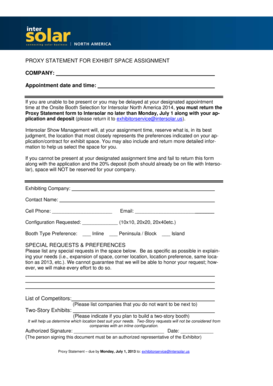

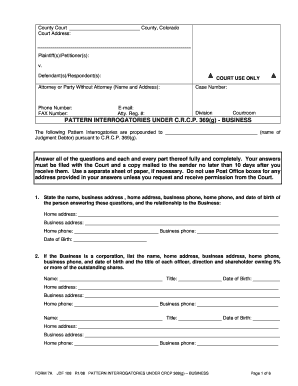

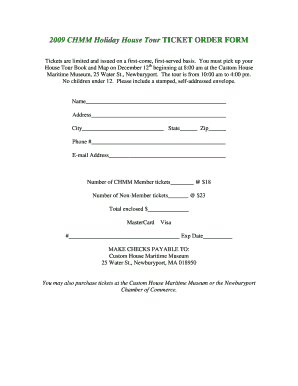

Basic Holiday Budgeting Worksheet: A simple worksheet that includes categories for different holiday expenses and allows you to input your estimated and actual spending.

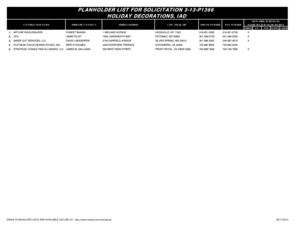

Detailed Holiday Budgeting Worksheet: A more comprehensive worksheet that includes additional categories for specific holiday expenses, such as gifts, food, travel, and decorations.

Digital Holiday Budgeting Spreadsheet: A digital spreadsheet that can be customized to suit your needs, with built-in formulas for calculating totals and tracking your spending.

Printable Holiday Budgeting Template: A pre-designed template that can be printed and filled out manually, providing a tangible way to track your holiday expenses.

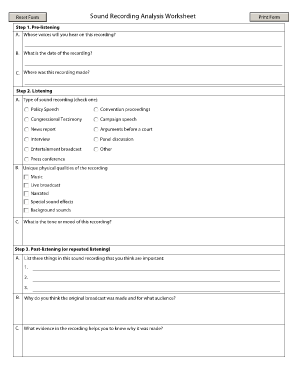

How to complete Holiday Budgeting Worksheet

Completing a Holiday Budgeting Worksheet is a simple process that helps you stay organized and keep your holiday spending in check. Follow these steps to complete your Holiday Budgeting Worksheet:

01

Begin by listing all the categories of holiday expenses you anticipate, such as gifts, decorations, travel, food, and entertainment.

02

Set a budget for each category based on your overall holiday budget.

03

As you make purchases or incur expenses, record the amount spent in the appropriate category of your worksheet.

04

Regularly review your spending against your budget to ensure you're staying on track.

05

Make adjustments to your spending habits if needed to stay within your budget.

06

At the end of the holiday season, evaluate your overall spending and use the information to plan for future holiday budgets.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.