Home Equity Loan Vs Line Of Credit

What is home equity loan vs line of credit?

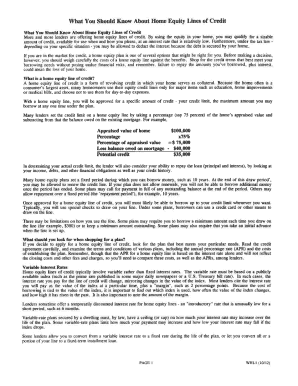

A home equity loan and a line of credit are both types of financing that allow homeowners to borrow against the equity they have built up in their homes. However, there are some key differences between the two. A home equity loan is a lump sum of money that is borrowed against the value of the home. It is typically repaid over a fixed term, with regular monthly payments. On the other hand, a line of credit allows homeowners to borrow money as needed, up to a certain credit limit. It functions more like a credit card, with interest only being charged on the amount borrowed.

What are the types of home equity loan vs line of credit?

There are several types of home equity loans and lines of credit available to homeowners. The most common types of home equity loans include fixed-rate loans and adjustable-rate loans. A fixed-rate home equity loan offers a predictable monthly payment and interest rate that does not change over the life of the loan. An adjustable-rate home equity loan, on the other hand, has an interest rate that can fluctuate over time. As for lines of credit, there are two main types: a traditional home equity line of credit (HELOC) and a home equity conversion mortgage (HECM). A traditional HELOC allows homeowners to borrow against their equity and repay the borrowed amount over time. A HECM, also known as a reverse mortgage, is a line of credit available to homeowners who are aged 62 or older.

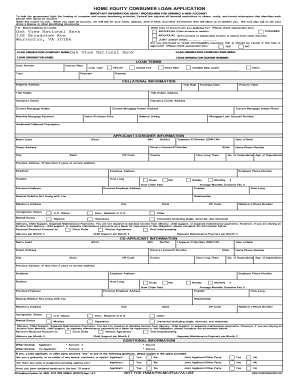

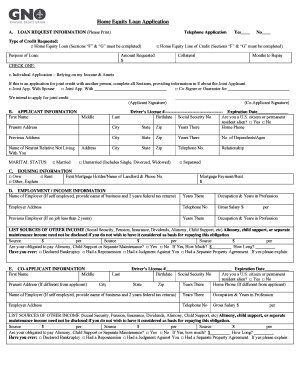

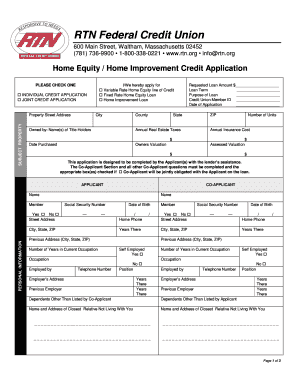

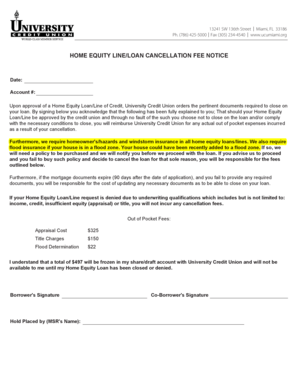

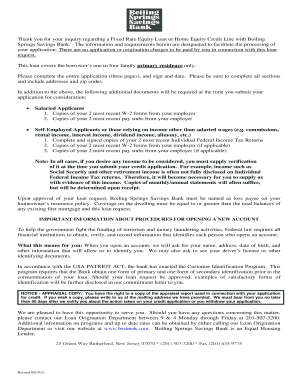

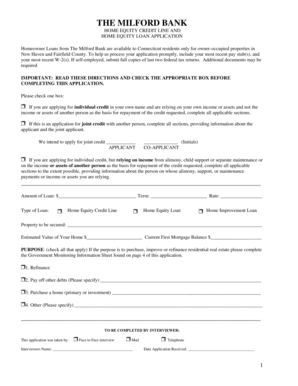

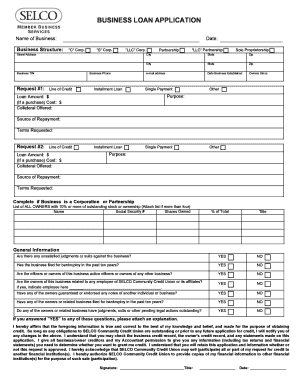

How to complete home equity loan vs line of credit

Completing a home equity loan or line of credit involves several steps. Here is a general guide to help you through the process: 1. Evaluate your financial situation and determine how much equity you have in your home. 2. Research and compare different lenders and their offerings. 3. Gather the necessary documents, such as proof of income and property information. 4. Submit an application with your chosen lender and await approval. 5. Once approved, review and sign the loan or line of credit agreement. 6. Use the funds as needed, making sure to adhere to the terms and repayment schedule. Remember, it's important to carefully consider your options and choose the financing option that best fits your needs and financial goals.

pdfFiller is here to empower you throughout your home equity loan or line of credit journey. With our online platform, you can easily create, edit, and share documents. We provide unlimited fillable templates and powerful editing tools, making us the only PDF editor you need to get your documents done efficiently and professionally.