How To Fill Out A Personal Financial Statement

What is how to fill out a personal financial statement?

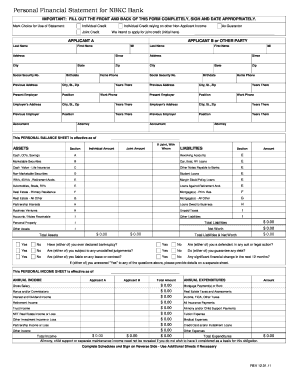

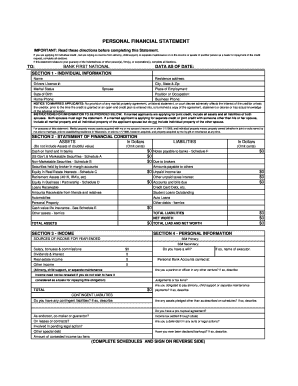

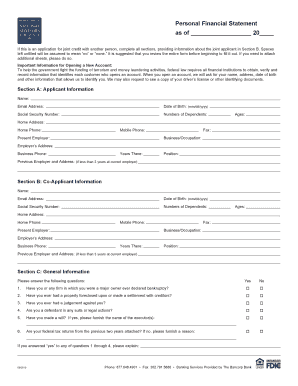

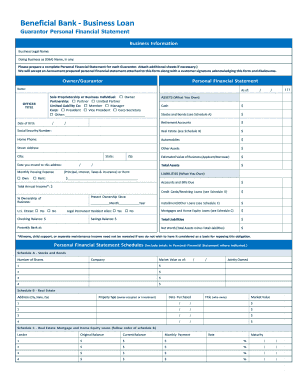

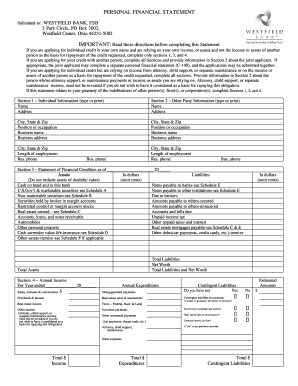

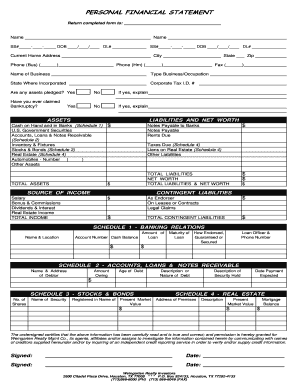

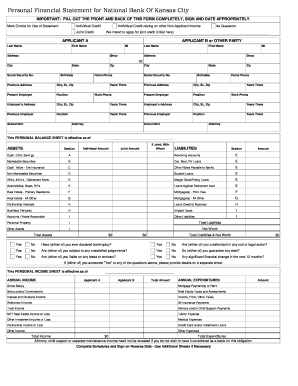

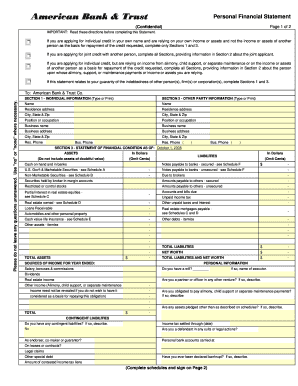

Filling out a personal financial statement can seem intimidating at first, but with the right guidance, it can be a straightforward process. A personal financial statement is a document that provides an overview of your financial situation, including your assets, liabilities, income, and expenses. It is commonly used by individuals to assess their financial health and make informed financial decisions. By accurately filling out a personal financial statement, you can gain a clear understanding of your current financial standing and plan for the future.

What are the types of how to fill out a personal financial statement?

There are two main types of personal financial statements: the balance sheet and the income statement. The balance sheet provides a snapshot of your financial position at a specific point in time, detailing your assets, liabilities, and net worth. On the other hand, the income statement focuses on your income and expenses over a specific period, typically a month or a year. Both types of financial statements are essential for understanding your overall financial situation and planning for your financial goals.

How to complete how to fill out a personal financial statement

To complete a personal financial statement effectively, consider following these steps:

By following these steps, you can confidently fill out a personal financial statement and gain a deeper understanding of your financial situation. Remember, always keep your financial statement up to date to track your progress and make informed decisions. As a user, you can take advantage of pdfFiller's online platform, which empowers you to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently complete your personal financial statement and other important documents.