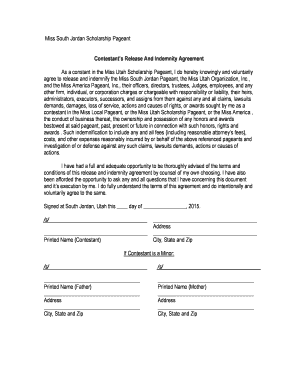

Indemnity Contract

What is indemnity contract?

An indemnity contract is a legal agreement between two parties that provides protection against financial losses or liability. It is a contract that ensures one party will compensate the other for any damages or losses incurred as a result of a specified event or action.

What are the types of indemnity contract?

There are several types of indemnity contracts designed to suit different situations. Some common types include:

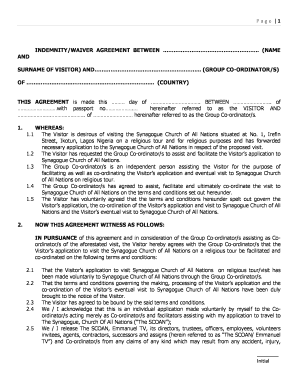

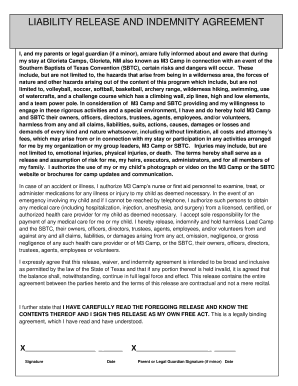

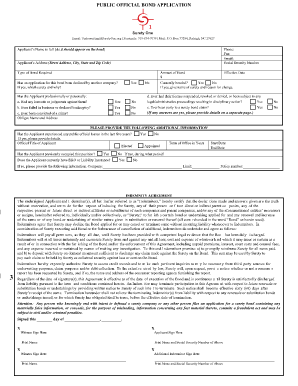

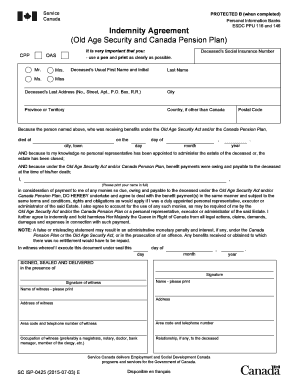

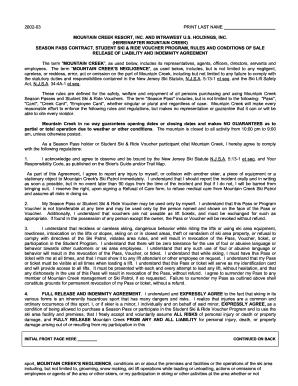

General Indemnity Agreement: This type of contract provides broad protection against all types of liability and losses.

Specific Indemnity Agreement: This contract focuses on a specific event or occurrence, providing protection only in relation to that particular event.

Joint and Several Indemnity Agreement: In this type of contract, multiple parties agree to be jointly and severally liable for any losses or damages that may occur.

Limited Indemnity Agreement: This contract offers protection for a limited scope of liability or losses, often specified in the agreement.

How to complete indemnity contract

Completing an indemnity contract can be done by following these steps:

01

Read and understand the contract: Familiarize yourself with the terms, conditions, and obligations stated in the agreement.

02

Include all necessary details: Fill in all relevant information, such as the names of the parties involved, the nature of the indemnity, and the compensation terms.

03

Review and revise if necessary: Double-check the contract for accuracy and make any necessary revisions to ensure clarity and completeness.

04

Get signatures: Make sure all parties involved sign the contract to indicate their agreement and acceptance of the terms.

05

Keep a copy: Retain a copy of the signed contract for your records and for reference in the event of any future disputes or claims.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out indemnity contract

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the three 3 methods of indemnity?

There are 3 levels of indemnification: broad form, intermediate form, and limited form. This requires the indemnitor to pay not only for its liabilities but also for the indemnitee's liability whether the indemnitee is solely (i.e. 100%) at fault or partially at fault.

How do you contract indemnity?

There are 3 levels of indemnification: broad form, intermediate form, and limited form. This requires the indemnitor to pay not only for its liabilities but also for the indemnitee's liability whether the indemnitee is solely (i.e. 100%) at fault or partially at fault.

How do you write an indemnity form?

In other words, it means that one party will compensate the other in case it suffers some losses. For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods.

What is an example of indemnity?

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

What is the most common form of indemnity agreement?

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity.

How do you write a Letter of indemnity?

How to fill a Letter of Indemnity? A letter of indemnity must include the following key details:- The names and addresses of both parties involved. The name and affiliation of the third party. Detailed descriptions of the items being shipped. Signatures of the parties. Date of execution of the contract.

Related templates