What is indemnity form meaning?

An indemnity form is a legal document that helps protect a party against possible losses or damages by shifting the responsibility of such risks to another party. It is commonly used in various situations where there is a potential for financial or legal liability. By signing an indemnity form, the party assumes the risk associated with a particular activity, service, or agreement, providing a level of financial protection.

What are the types of indemnity form meaning?

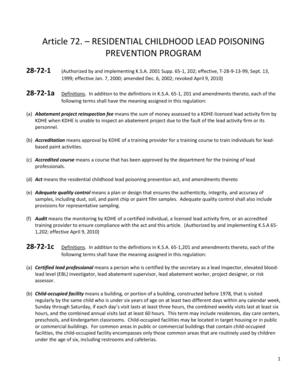

There are several types of indemnity forms, each serving a specific purpose. Some common types include:

General indemnity form: This form ensures that one party is protected against potential losses or damages arising from a specific situation or transaction.

Hold harmless agreement: This agreement protects one party from liabilities, claims, or damages that may arise from the actions or negligence of another party.

Limited liability clause: This clause limits the extent of financial responsibility of one party in case of certain events or occurrences.

Waiver and release form: This form releases one party from any legal liability or claim that may arise from participation in a particular activity or event.

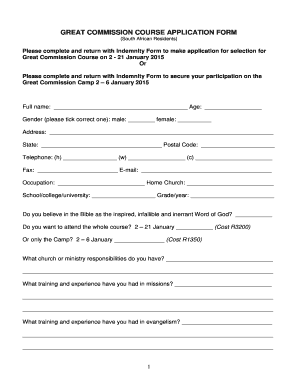

How to complete indemnity form meaning

Completing an indemnity form is a straightforward process. Here are the steps to follow:

01

Read the form carefully and ensure you understand its terms and conditions.

02

Provide accurate and complete information in the required fields.

03

Review the form before signing it to verify that all information is correct.

04

If necessary, seek legal advice before signing the indemnity form to fully understand its implications and obligations.

05

Keep a copy of the signed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.