Independent Contractor Agreement

What is Independent Contractor Agreement?

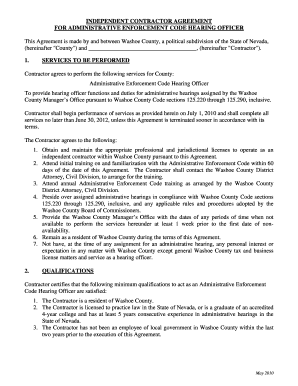

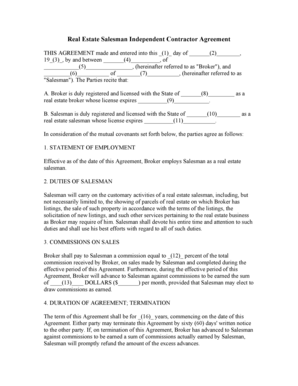

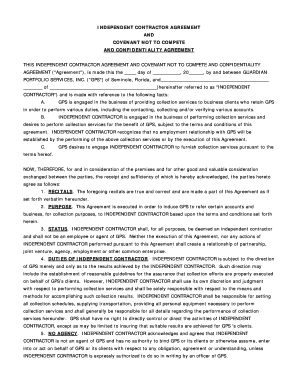

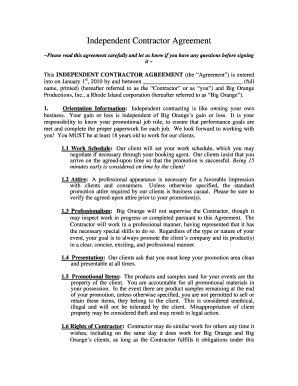

An Independent Contractor Agreement is a legal document that defines the working relationship between a business or individual and an independent contractor. It outlines the terms and conditions of the agreement, including the scope of work, payment terms, and responsibilities of both parties involved. This agreement allows businesses to hire independent contractors who can work on specific projects or tasks without being classified as employees.

What are the types of Independent Contractor Agreement?

There are various types of Independent Contractor Agreements based on the specific nature of the work and industry. Some common types include: 1. General Independent Contractor Agreement: This is a basic agreement that covers the general terms and conditions of the independent contractor's engagement. 2. Consulting Independent Contractor Agreement: This type of agreement is used when hiring a consultant to provide professional advice or expertise. 3. Freelance Independent Contractor Agreement: It is used when engaging freelancers or self-employed individuals for specific tasks or projects. 4. Construction Independent Contractor Agreement: This agreement is specific to the construction industry, outlining the terms for hiring independent contractors for construction projects. 5. Confidentiality Independent Contractor Agreement: This type of agreement specifies the confidentiality obligations of the independent contractor when dealing with sensitive information.

How to complete Independent Contractor Agreement

Completing an Independent Contractor Agreement is simple. Follow these steps:

By using pdfFiller, you can easily create, edit, and share your Independent Contractor Agreements online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to streamline your document workflow.