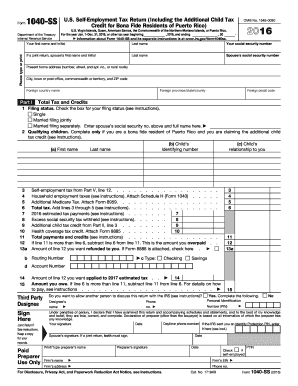

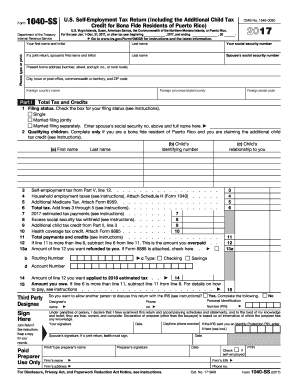

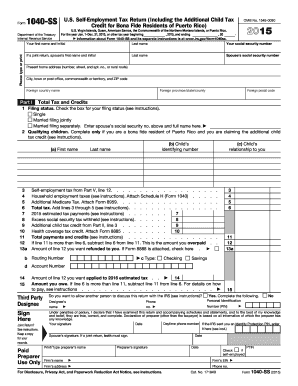

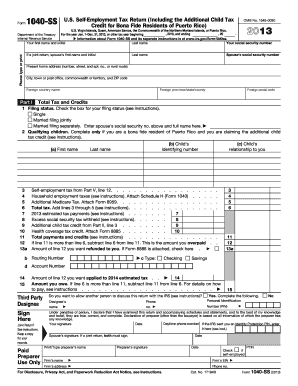

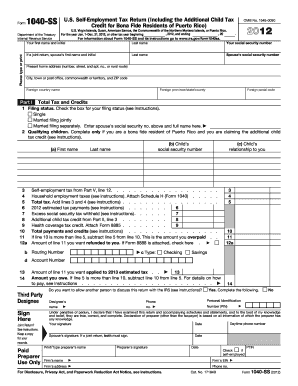

1040-SS Form

What is 1040-SS Form?

The 1040-SS Form is a tax form used by individuals who are taxpayers in the U.S. and are self-employed or have earnings from farm or fishing activities. This form is specifically designed for residents of Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands. It is used to report and pay self-employment tax and income tax liability to the Internal Revenue Service (IRS).

What are the types of 1040-SS Form?

There are two types of 1040-SS Forms:

How to complete 1040-SS Form

Completing the 1040-SS Form may seem complex, but with the right guidance, it can be done easily. Here is a step-by-step guide on how to complete the form:

When completing the 1040-SS Form, it's important to ensure accuracy and comply with all applicable tax laws. If you need assistance or want a convenient way to fill out the form online, consider using pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.