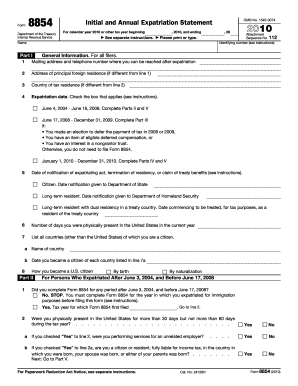

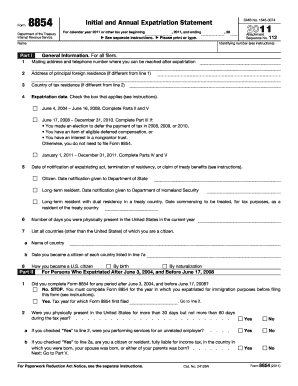

8854 Form

What is 8854 Form?

The 8854 Form, also known as the Initial and Annual Expatriation Statement, is a crucial document required by the Internal Revenue Service (IRS) for individuals who have chosen to renounce their U.S. citizenship or long-term residency status. It helps the IRS determine the tax implications of expatriation and ensures compliance with tax obligations.

What are the types of 8854 Form?

There are two main types of 8854 Form based on an individual's expatriation status: 1. Form 8854 (Initial Statement): This form is used when an individual formally renounces their U.S. citizenship or long-term residency status. It provides the necessary information about their assets, income, and other financial details that may affect tax liability. 2. Form 8854 (Annual Statement): This form is required to be filed annually by individuals who have previously expatriated. It updates their financial information and discloses any changes that may impact their tax obligations. This annual reporting helps the IRS ensure proper tax compliance for those who have renounced their citizenship or long-term residency.

How to complete 8854 Form

Completing the 8854 Form is a detailed process, but with careful attention to the following steps, you can ensure accuracy and compliance: 1. Gather all required information: Collect relevant financial documents, including records of assets, income, and liabilities. Ensure you have accurate information about your citizenship or residency status as well. 2. Fill in personal details: Provide your full name, address, Social Security number, and other required identification information. 3. Complete Part I: Follow the instructions to complete Part I of the form, providing details about your expatriation and tax status. 4. Fill in financial details: Move on to Part II of the form, where you will disclose information about your assets, income sources, and any changes from the previous year. 5. Review and sign: Double-check all the provided information, make any necessary corrections, and sign the form accordingly. 6. Submit the form: Send the completed 8854 Form to the IRS according to their instructions, ensuring it reaches them before the deadline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.