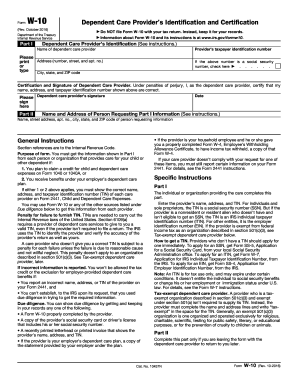

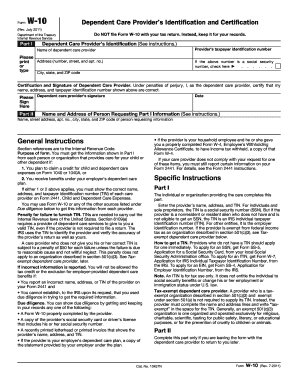

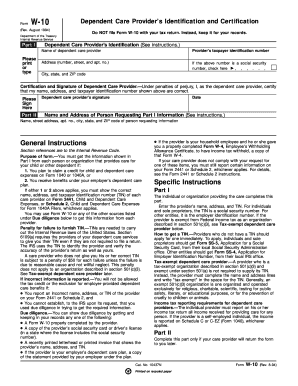

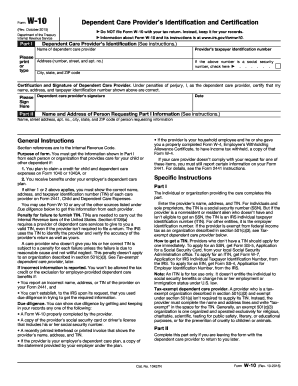

W-10 Form

What is W-10 Form?

The W-10 Form is a document used by the Internal Revenue Service (IRS) to gather information about individuals who are claiming exemption from U.S. withholding tax. It is typically completed by non-resident aliens who have income from U.S. sources and are eligible for a tax treaty benefit.

What are the types of W-10 Form?

There are two main types of W-10 Forms: W-10 for non-resident aliens claiming treaty benefits and W-10 for non-resident aliens withholding on payments that are not effectively connected with a U.S. trade or business.

How to complete W-10 Form

Completing the W-10 Form is a straightforward process. Here are the steps you need to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.