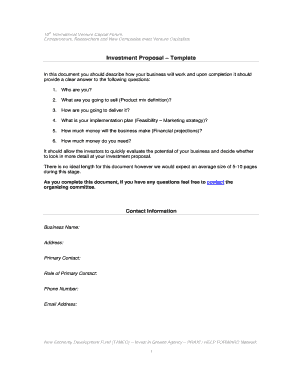

What is Investment Proposal Template?

An Investment Proposal Template is a document that outlines the details and key aspects of an investment opportunity. It provides a clear and structured format for presenting the investment idea to potential investors or stakeholders. This template helps in organizing and conveying important information about the investment, such as the project description, financial projections, return on investment, and potential risks and rewards.

What are the types of Investment Proposal Template?

There are several types of Investment Proposal Templates available to cater to different investment needs and industries. Some common types include:

Equity Investment Proposal Template: This type of template is suitable for businesses looking for equity investments, where investors receive ownership shares in exchange for funds.

Real Estate Investment Proposal Template: This template is designed specifically for real estate investment opportunities, providing information on property details, market analysis, and potential returns.

Business Loan Proposal Template: For businesses seeking loans from banks or financial institutions, this template helps in presenting the business plan, financial projections, and repayment strategy.

Startup Investment Proposal Template: Startups can use this template to outline their business model, market potential, competitive analysis, and funding requirements.

Project Investment Proposal Template: This template focuses on presenting investment opportunities in specific projects, such as infrastructure development, technology implementation, or research initiatives.

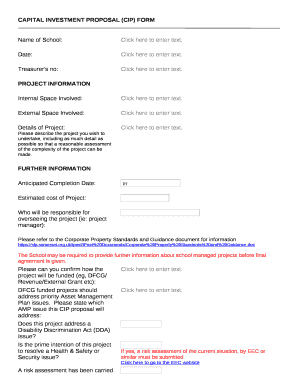

How to complete Investment Proposal Template

Completing an Investment Proposal Template is a crucial step in effectively communicating your investment opportunity. Here are the key steps to follow:

01

Start with a compelling introduction that grabs the reader's attention and provides a brief overview of the investment opportunity.

02

Clearly define the investment objective, describing the purpose and goals of the investment.

03

Provide detailed information about the project or business, including market analysis, competitive landscape, and potential risks and challenges.

04

Present financial projections, including revenue forecasts, expenses, and expected return on investment.

05

Outline the investment terms and conditions, such as the amount of investment required, expected timeline, and potential exit strategies for investors.

06

Include supporting documents, such as market research reports, legal documentation, and team profiles.

07

Review and revise the proposal to ensure clarity, coherence, and accuracy before finalizing it for presentation to potential investors.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.