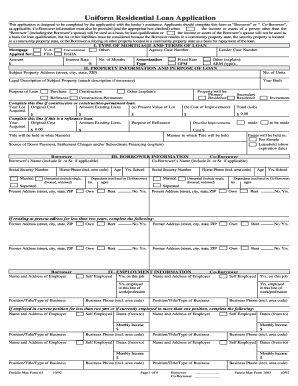

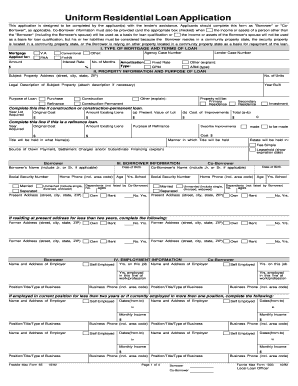

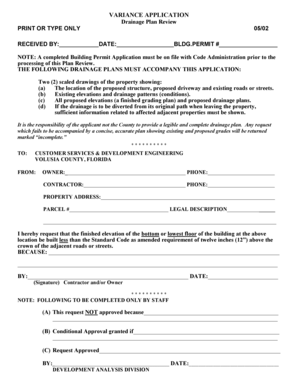

Loan Application Form

What is Loan Application Form?

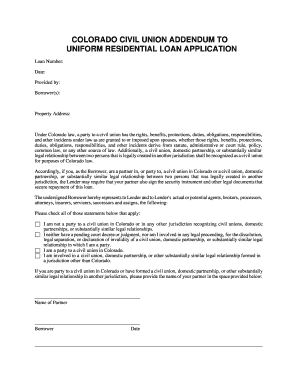

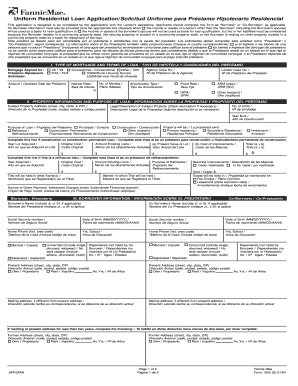

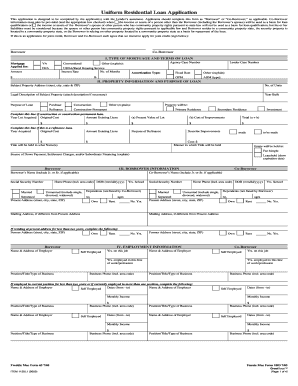

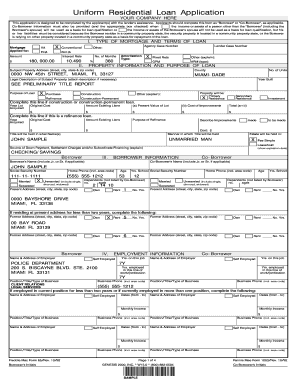

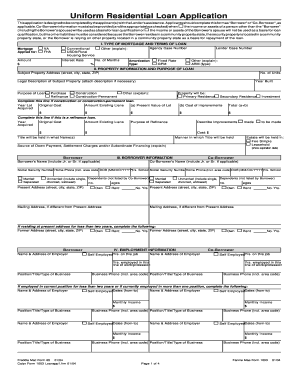

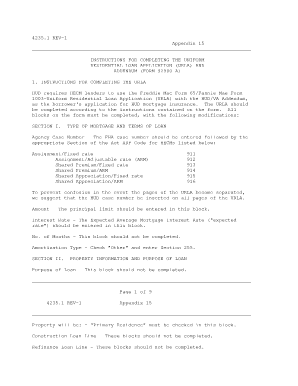

A loan application form is a document that individuals or businesses fill out to apply for a loan. It contains various sections and fields where the applicant provides personal and financial information, such as their name, contact details, employment history, income, expenses, assets, and liabilities. The purpose of this form is to help lenders assess the creditworthiness of the applicant and determine whether they qualify for a loan.

What are the types of Loan Application Form?

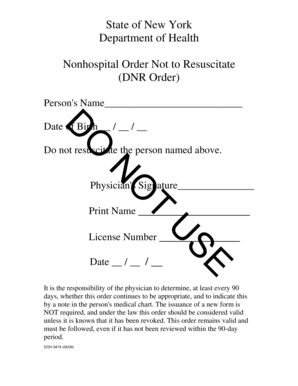

Loan application forms can vary depending on the type of loan being applied for. Some common types include:

How to complete Loan Application Form

Completing a loan application form may seem overwhelming, but with the right guidance, it can be a straightforward process. Here are the steps to complete a loan application form:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.