Loan Calculator Car

What is loan calculator car?

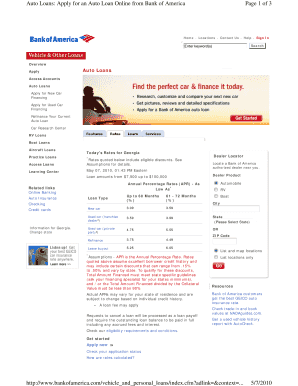

A loan calculator car is a financial tool that allows individuals to determine the monthly payment and interest rate of a car loan based on factors such as the loan amount, term length, and interest rate.

What are the types of loan calculator car?

There are several types of loan calculator car available, including:

Simple loan calculator: This type of calculator provides a basic estimation of the monthly payment based on the loan amount, interest rate, and term length.

Amortization calculator: This calculator helps individuals determine how much of their monthly payment goes towards the principal and interest over the course of the loan.

Affordability calculator: This tool helps individuals determine how much car they can afford by taking into account factors such as income, expenses, and desired loan term.

How to complete loan calculator car

To complete a loan calculator car, follow these steps:

01

Enter the loan amount: Input the total amount of money you plan to borrow for the car loan.

02

Input the interest rate: Enter the annual interest rate at which the loan will accrue.

03

Set the loan term: Specify the length of time over which you will repay the loan.

04

Click calculate: Once you have entered all the necessary information, click the calculate button to generate the monthly payment and interest rate.

05

Analyze the results: Review the monthly payment and interest rate to determine if it fits within your budget and financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out loan calculator car

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a loan sheet in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

Does Excel have a loan amortization schedule?

Microsoft's Excel loan amortization schedule As you can see, it has a few boxes to enter the loan information, such as loan amount and interest rate. Then it contains an amortization table with information about each monthly payment. It also helps you see how many of your dollars are going to principal vs. interest.

What is the formula to calculate a car loan?

The equation to calculate principal, P, interest rate, r, and number of monthly payments, m. Payment = [P ( r / 12 )] / [1 - ( 1 + r / 12 )-m] For example, a 3 year (36 month) loan of $15,000 at 7% interest would look like this: Payment = [15000 ( 0.07/ 12 )]/ [ (1 - ( 1 + 0.07 / 12 )-36)

How do I make a payment sheet in Excel?

How to Create an Invoice in Excel from Scratch Open a Blank Excel Workbook. Create an Invoice Header. Add the Client's Information. List the Payment Due Date. Add an Itemized List of Services. Add the Total Amount Owing. Include Your Payment Terms.

How do I calculate how much interest I will pay on a car loan?

How to Figure Interest on a Car Loan for First Payment Divide your interest rate by the number of monthly payments per year. Multiply the monthly payment by the balance of your loan. The amount you calculate is the interest rate you will pay for your first month's payment.

How can I estimate my interest rate?

To calculate interest rate, start by multiplying your principal, which is the amount of money before interest, by the time period involved (weeks, months, years, etc.). Write that number down, then divide the amount of paid interest from that month or year by that number.

Related templates