What is Medical Mileage Expense Form?

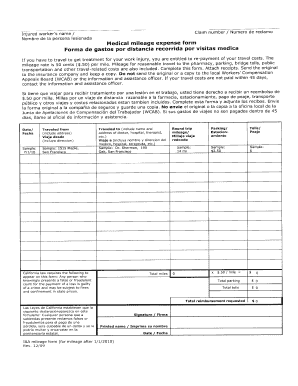

The Medical Mileage Expense Form is a document used to track and report the mileage expenses incurred for medical purposes. It is commonly used by individuals who need to travel to receive medical treatment or services. This form allows users to document the distance traveled, the purpose of the trip, and any associated expenses, such as fuel costs or toll fees. By keeping accurate records with the Medical Mileage Expense Form, individuals can claim these expenses for reimbursement or as a tax deduction.

What are the types of Medical Mileage Expense Form?

There are several types of Medical Mileage Expense Forms available, depending on the specific requirements and regulations of the organization or entity involved. Some common types include:

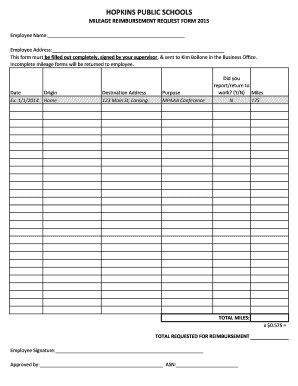

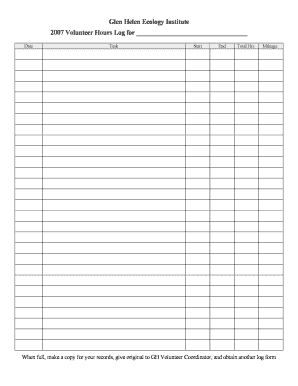

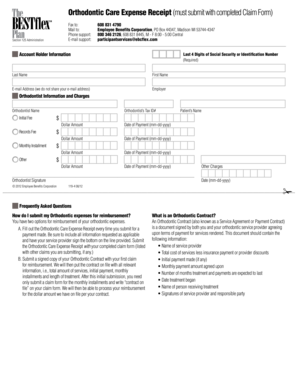

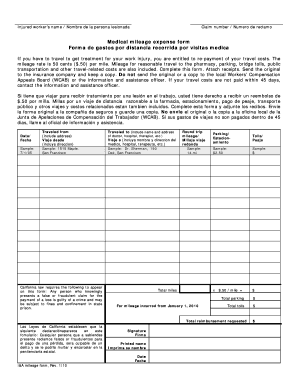

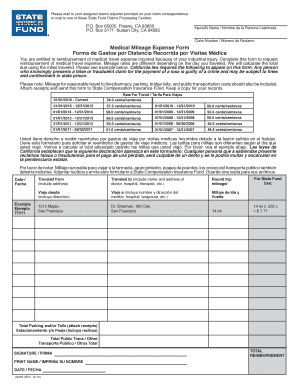

Standard Medical Mileage Expense Form: This is the most basic form used to track medical mileage expenses. It usually includes fields for date, purpose of the trip, starting and ending locations, distance traveled, and associated costs.

Detailed Medical Mileage Expense Form: This form provides more comprehensive information about each trip, including the specific medical services received and the healthcare provider's name and contact information.

Electronic Medical Mileage Expense Form: This is a digital form that can be filled out online or through a computer software. It allows for easy data entry, automatic calculations, and electronic submission.

How to complete Medical Mileage Expense Form

Completing a Medical Mileage Expense Form is a straightforward process. Here are the steps to follow:

01

Gather the necessary information: Collect all the relevant details, such as the date of each trip, purpose of the trip, starting and ending locations, distance traveled, and any associated expenses.

02

Fill in the form: Enter the collected information into the appropriate fields of the form. Make sure to double-check the accuracy of the data.

03

Calculate the total expenses: If required, calculate the total expenses by adding up the associated costs, such as fuel costs or toll fees.

04

Review and submit: Before submitting the form, review all the entered information to ensure it is accurate and complete. If submitting a physical form, make a copy for your records.

By following these steps, you can successfully complete a Medical Mileage Expense Form and keep track of your medical-related travel expenses efficiently. Remember to retain any supporting documentation, such as receipts, to validate your claims.