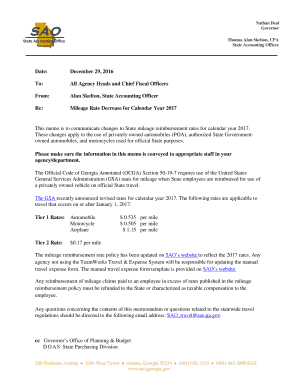

What is mileage reimbursement 2017?

Mileage reimbursement refers to the compensation provided by an employer to employees for using their personal vehicles for work-related purposes. In 2017, the reimbursement rates were set by the Internal Revenue Service (IRS) and varied depending on the purpose of the travel. The purpose could be either business-related or medical and charitable activities.

What are the types of mileage reimbursement 2017?

In 2017, there were three types of mileage reimbursement rates recognized by the IRS. These types included:

Business Mileage Rate: This rate was applicable for travel that was business-related. The IRS set the standard mileage rate for business mileage reimbursement.

Medical Mileage Rate: This rate applied to travel related to medical activities, such as traveling to receive medical care or to accompany a patient for treatment.

Charitable Mileage Rate: This rate was for travel associated with charitable activities, like volunteering for a qualified organization.

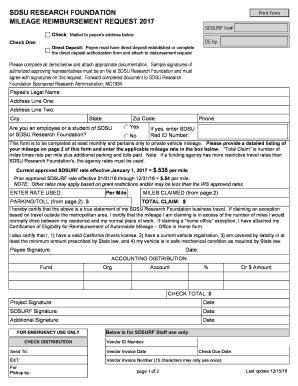

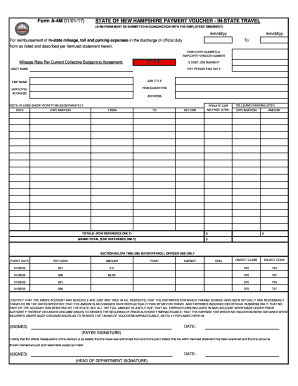

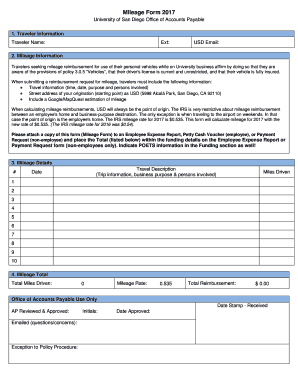

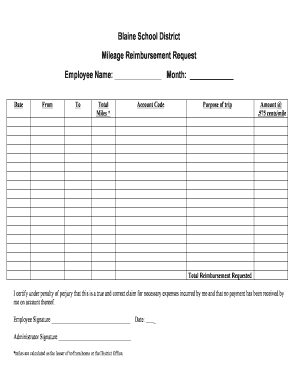

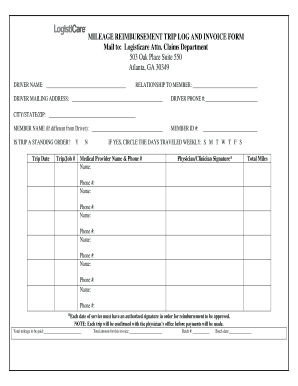

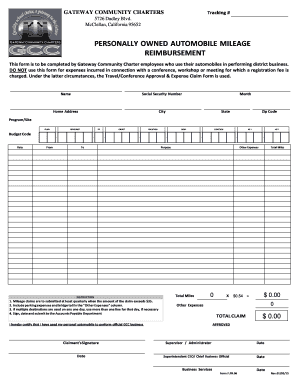

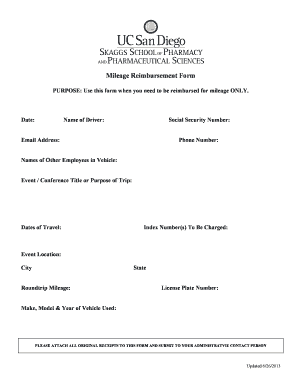

How to complete mileage reimbursement 2017

To complete mileage reimbursement for 2017, follow these steps:

01

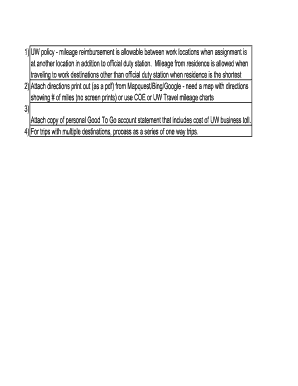

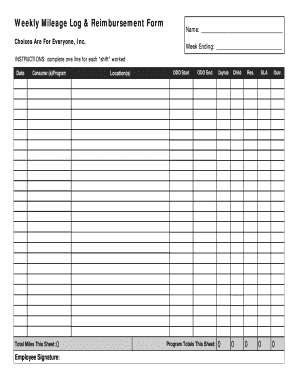

Record your mileage: Keep track of the miles driven for business, medical, and charitable purposes. Make sure to document the starting and ending mileage for each trip.

02

Calculate the reimbursement amount: Multiply the total number of miles driven for each purpose by the applicable reimbursement rate set by the IRS.

03

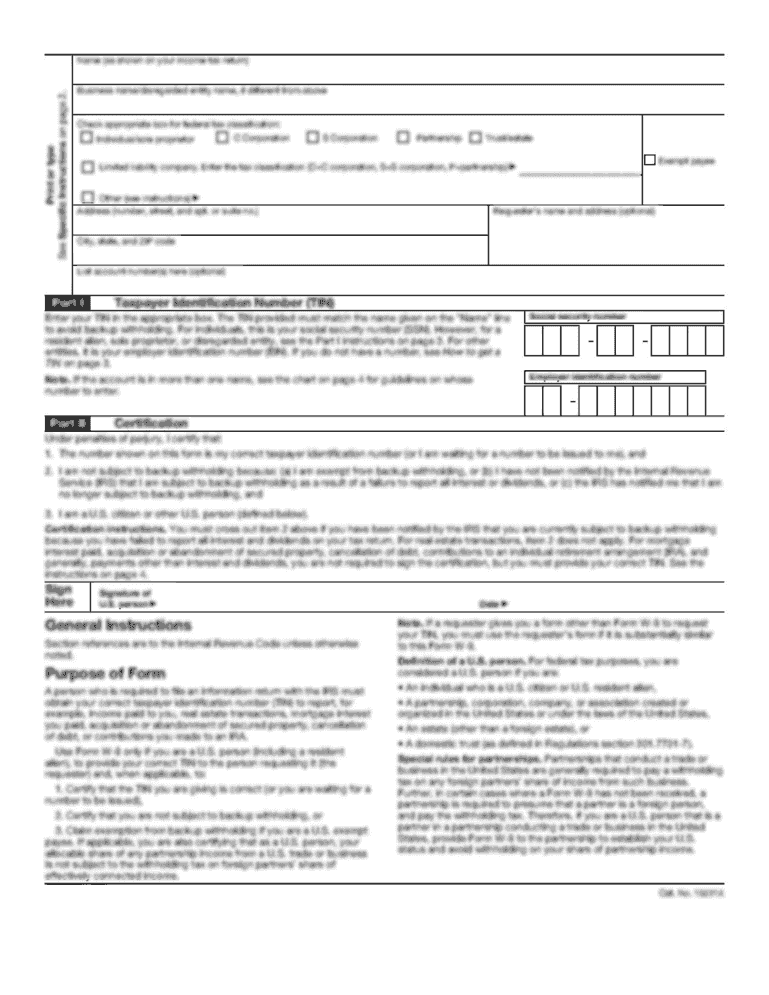

Prepare the reimbursement form: Fill out the necessary information, including your name, employer's name, purpose of travel, and reimbursement amount.

04

Submit the form: Submit the completed reimbursement form to your employer along with any supporting documentation, such as a mileage log.

05

Receive the reimbursement: Once your employer approves the reimbursement request, you will receive the corresponding amount for the miles driven.

pdfFiller empowers users to create, edit, and share documents online, including mileage reimbursement forms. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently complete their mileage reimbursement forms for 2017.