Mortgage Calculator With Taxes And Insurance

What is mortgage calculator with taxes and insurance?

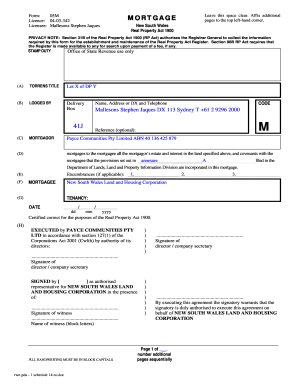

A mortgage calculator with taxes and insurance is a valuable tool that helps individuals estimate their monthly mortgage payments. It takes into account not only the principal and interest amount but also factors in the taxes and insurance related to the property. By inputting specific values such as the loan amount, interest rate, property taxes, and insurance costs, the calculator provides an accurate estimate of the total monthly payment. This allows users to plan their finances effectively and make informed decisions about purchasing a property.

What are the types of mortgage calculator with taxes and insurance?

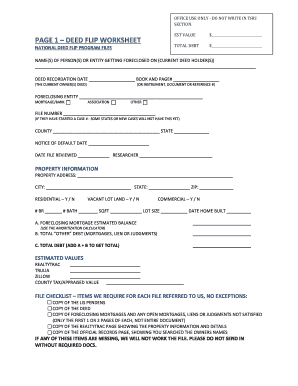

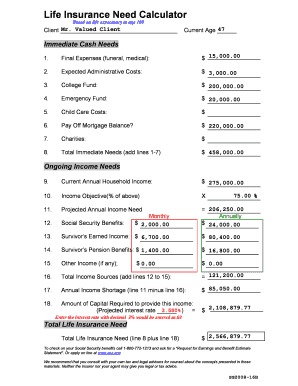

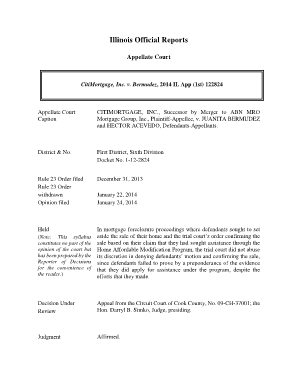

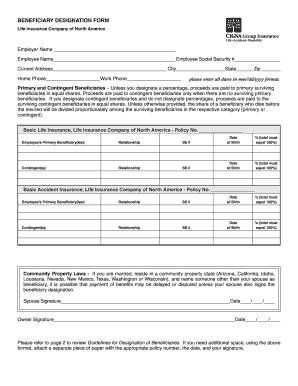

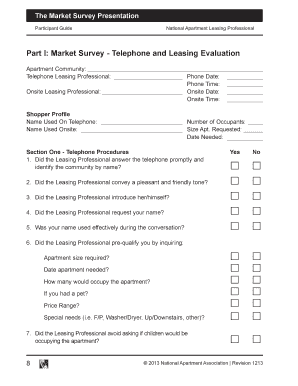

There are various types of mortgage calculators with taxes and insurance available to users. Some of the common types include: 1. Basic Mortgage Calculator: This type of calculator provides a simple estimation of the monthly mortgage payment by considering the loan amount, interest rate, and term. 2. Advanced Mortgage Calculator: This type of calculator allows users to input additional details such as property taxes, insurance costs, and down payment amount to get a more accurate estimate. 3. Refinance Calculator: This calculator helps users calculate the potential savings of refinancing their mortgage by taking into account taxes, insurance, and closing costs. 4. Amortization Calculator: This type of calculator shows users a complete payment schedule, including principal and interest amounts, taxes, and insurance over the loan term.

How to complete mortgage calculator with taxes and insurance

Completing a mortgage calculator with taxes and insurance is a straightforward process. Follow these steps: 1. Gather the necessary information: - Loan amount: The total amount of money borrowed for the mortgage. - Interest rate: The percentage charged by the lender on the loan. - Loan term: The duration of the mortgage repayment. - Property taxes: The annual tax amount imposed on the property. - Insurance costs: The cost of insuring the property. 2. Choose a mortgage calculator: Select the type of mortgage calculator that suits your needs, whether it's a basic, advanced, refinance, or amortization calculator. 3. Input the information: Enter the gathered information into the respective fields of the calculator. 4. Calculate the monthly payment: Once all the information is entered, click on the calculate button to obtain the estimated monthly mortgage payment. 5. Review and analyze the results: Take a close look at the calculated results, which will include the total payment, including taxes and insurance, and determine if it fits within your budget and financial goals. By following these steps, you can easily complete a mortgage calculator with taxes and insurance to help you make informed decisions about your mortgage financing options.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.