Mortgage Form Sample

What is Mortgage Form Sample?

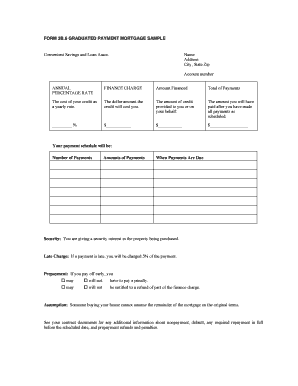

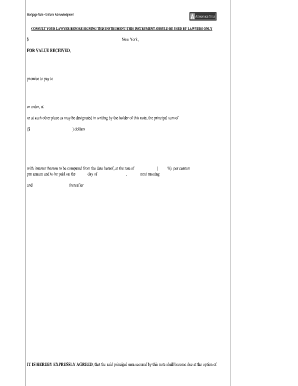

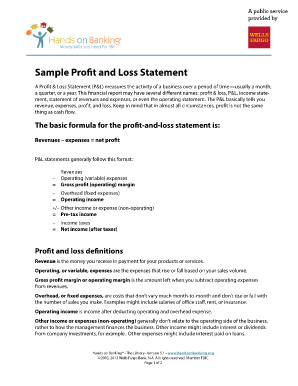

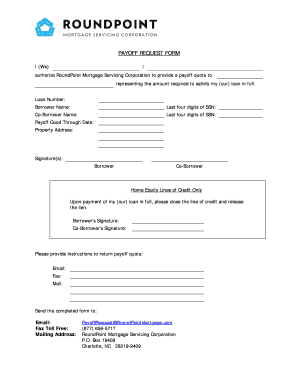

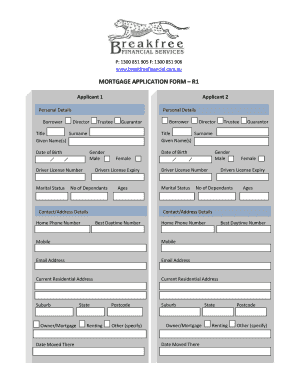

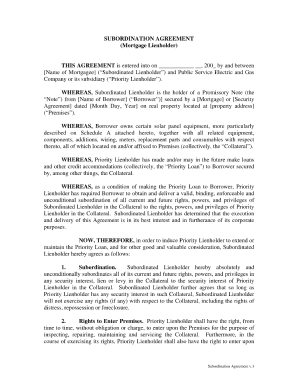

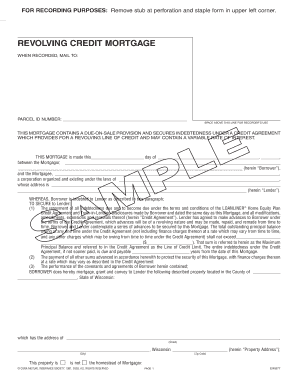

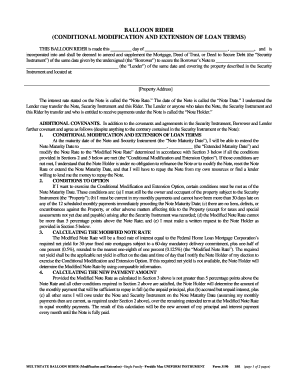

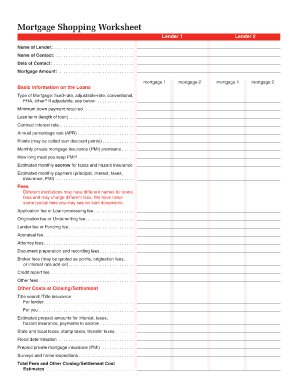

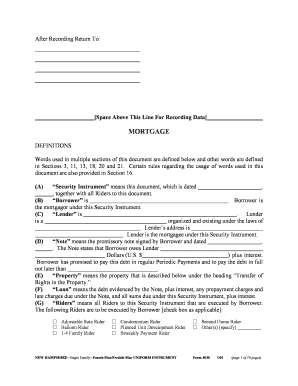

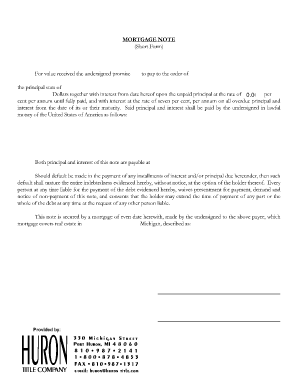

A Mortgage Form Sample is a document that outlines the terms and conditions of a mortgage loan. It includes important details such as the loan amount, interest rate, repayment schedule, and any additional fees or clauses. Mortgage Form Samples are typically used by both lenders and borrowers to formalize the mortgage agreement and ensure all parties are aware of their rights and obligations.

What are the types of Mortgage Form Sample?

There are several types of Mortgage Form Samples available, depending on the specific needs of the parties involved. Some common types include: 1. Fixed-Rate Mortgage Form Sample: This type of mortgage has a fixed interest rate for the duration of the loan, providing borrowers with predictable monthly payments. 2. Adjustable-Rate Mortgage Form Sample: With this type of mortgage, the interest rate may fluctuate over time, resulting in varying monthly payments. 3. Balloon Mortgage Form Sample: These mortgages have lower monthly payments initially but require a larger payment or refinancing at the end of a specified period.

How to complete Mortgage Form Sample

Completing a Mortgage Form Sample may seem daunting, but with the right guidance, it can be a straightforward process. Here's a step-by-step guide to help you:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.