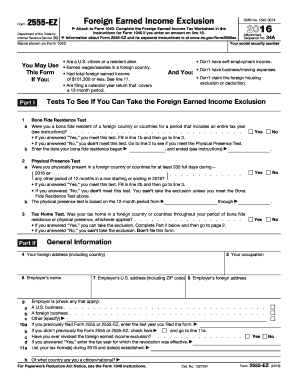

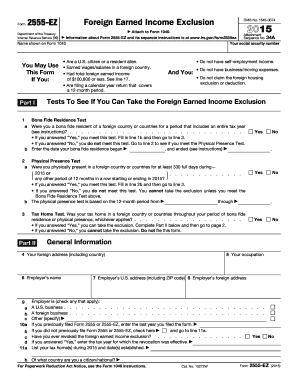

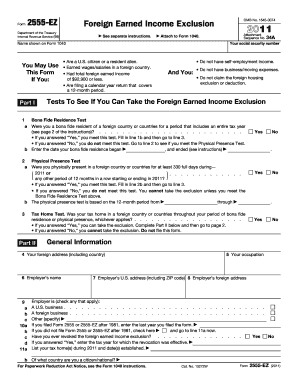

2555-EZ Form

What is 2555-EZ Form?

The 2555-EZ Form is a tax form used by U.S. citizens or resident aliens who qualify for the Foreign Earned Income Exclusion (FEIE) and meet certain requirements. This form allows taxpayers to exclude a portion or all of their foreign earned income from U.S. taxation.

What are the types of 2555-EZ Form?

There is only one type of 2555-EZ Form, which is the standard form used to claim the Foreign Earned Income Exclusion. It is specifically designed for eligible taxpayers who have a simpler tax situation and meet the criteria for using this simplified form.

How to complete 2555-EZ Form

Completing the 2555-EZ Form is a relatively straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.