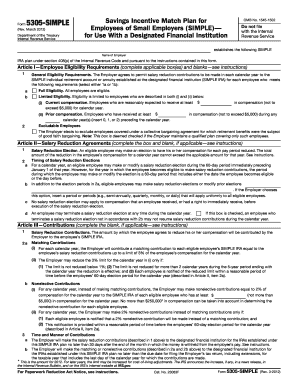

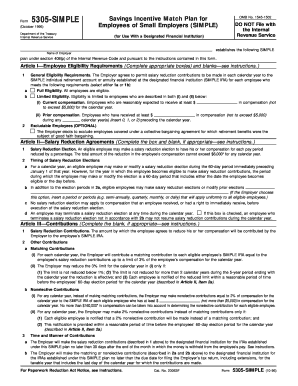

5305-SIMPLE Form

What is 5305-SIMPLE Form?

The 5305-SIMPLE Form is a document used by employers to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. It allows employees to make salary reduction contributions to their retirement accounts, while employers can choose to make matching or nonelective contributions. This form serves as an agreement between the employer and employees, outlining the terms and conditions of the retirement plan.

What are the types of 5305-SIMPLE Form?

There are two types of 5305-SIMPLE Forms: Form 5305-SIMPLE for individual employers and Form 5305-SA for multiple employers. The individual employer form is used when there is only one employer sponsoring the SIMPLE IRA plan, while the multiple employer form is used when multiple employers join together to offer a single plan to their employees.

How to complete 5305-SIMPLE Form

Completing the 5305-SIMPLE Form is a straightforward process. Here are the steps you need to follow:

By using pdfFiller, you can easily complete the 5305-SIMPLE Form online. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently.