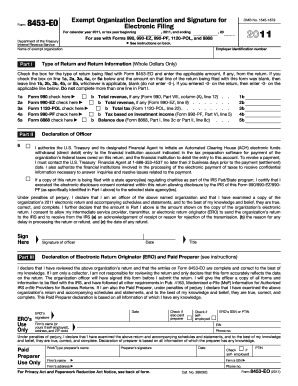

8453-EO Form

What is 8453-EO Form?

The 8453-EO Form is a document used by tax-exempt organizations to authorize an electronic return originator (ERO) to electronically file their tax returns. It is specifically designed for tax-exempt organizations, such as those exempt under section 501(c)(3) or 501(c)(4) of the Internal Revenue Code.

What are the types of 8453-EO Form?

There are two types of 8453-EO Forms: one for the initial filing of the tax return and another for amended filings. The initial filing form is used when submitting the tax return for the first time, while the amended filing form is used to make changes or corrections to a previously filed tax return.

How to complete 8453-EO Form

Completing the 8453-EO Form is a straightforward process. Here are the steps to follow:

With pdfFiller, completing the 8453-EO Form becomes even easier. You can create, edit, and share the form online with ease. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the only PDF editor you need to get your tax-exempt organization's documents done efficiently.