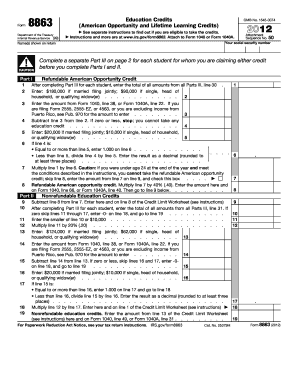

8863 Form

What is 8863 Form?

The 8863 Form, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is a form provided by the Internal Revenue Service (IRS) for taxpayers to claim educational tax credits. It is used to calculate and report the amount of education credits that can be claimed on a tax return.

What are the types of 8863 Form?

There are two types of 8863 Forms: the American Opportunity Credit (AOC) and the Lifetime Learning Credit (LLC). The AOC is available to eligible students pursuing a degree or other recognized credential, while the LLC is available to eligible students and parents who pay qualified education expenses.

How to complete 8863 Form

Completing the 8863 Form is relatively straightforward. Here are the steps you need to follow:

By using pdfFiller, you can easily complete and file your 8863 Form online. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to efficiently handle their tax documents and other paperwork.